Rexpro Enterprises IPO

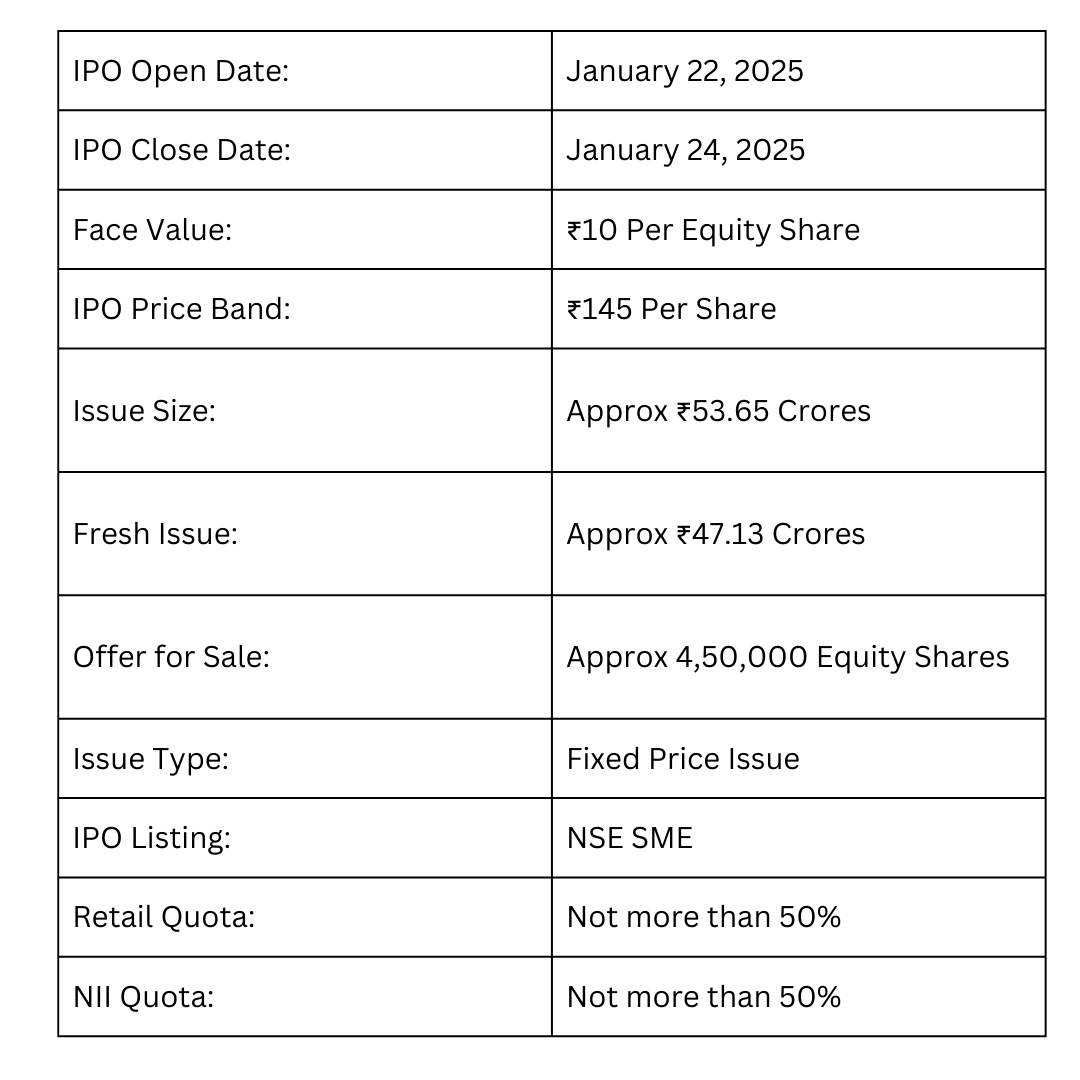

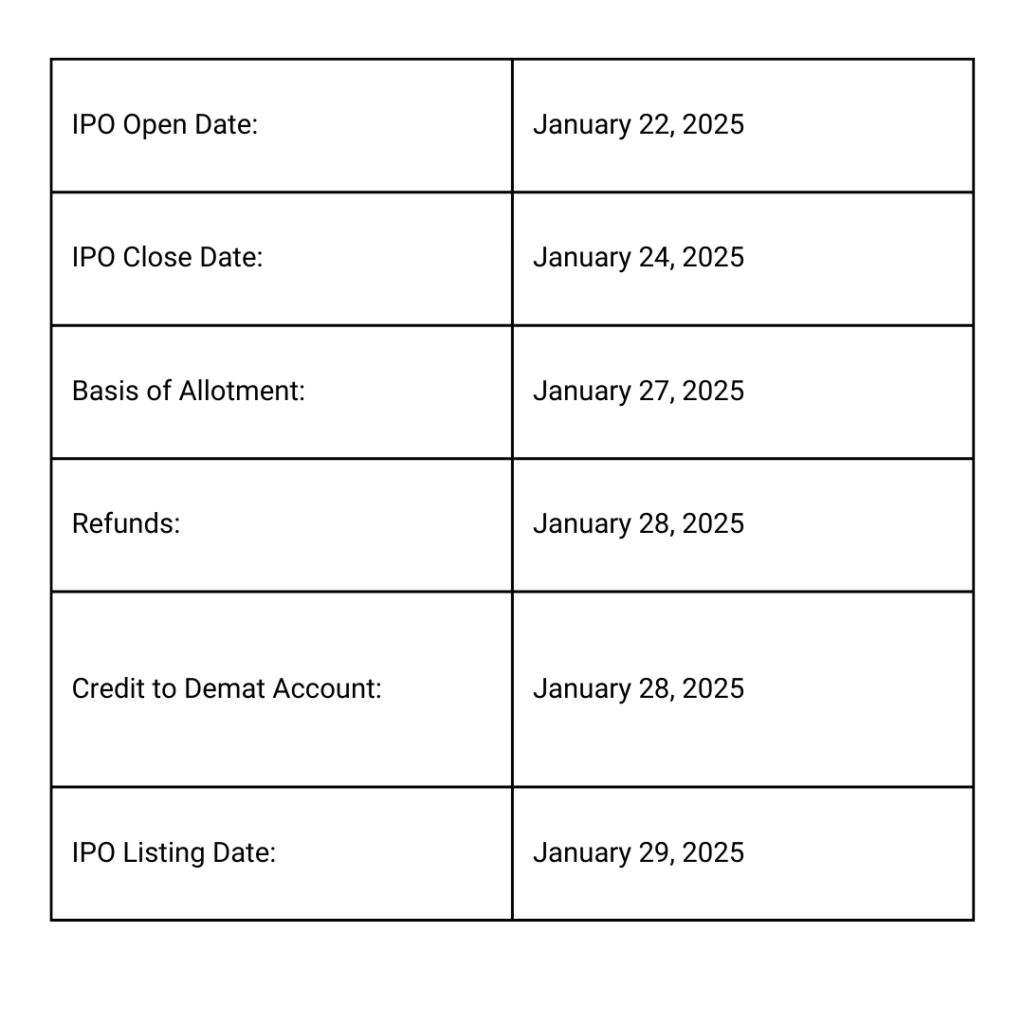

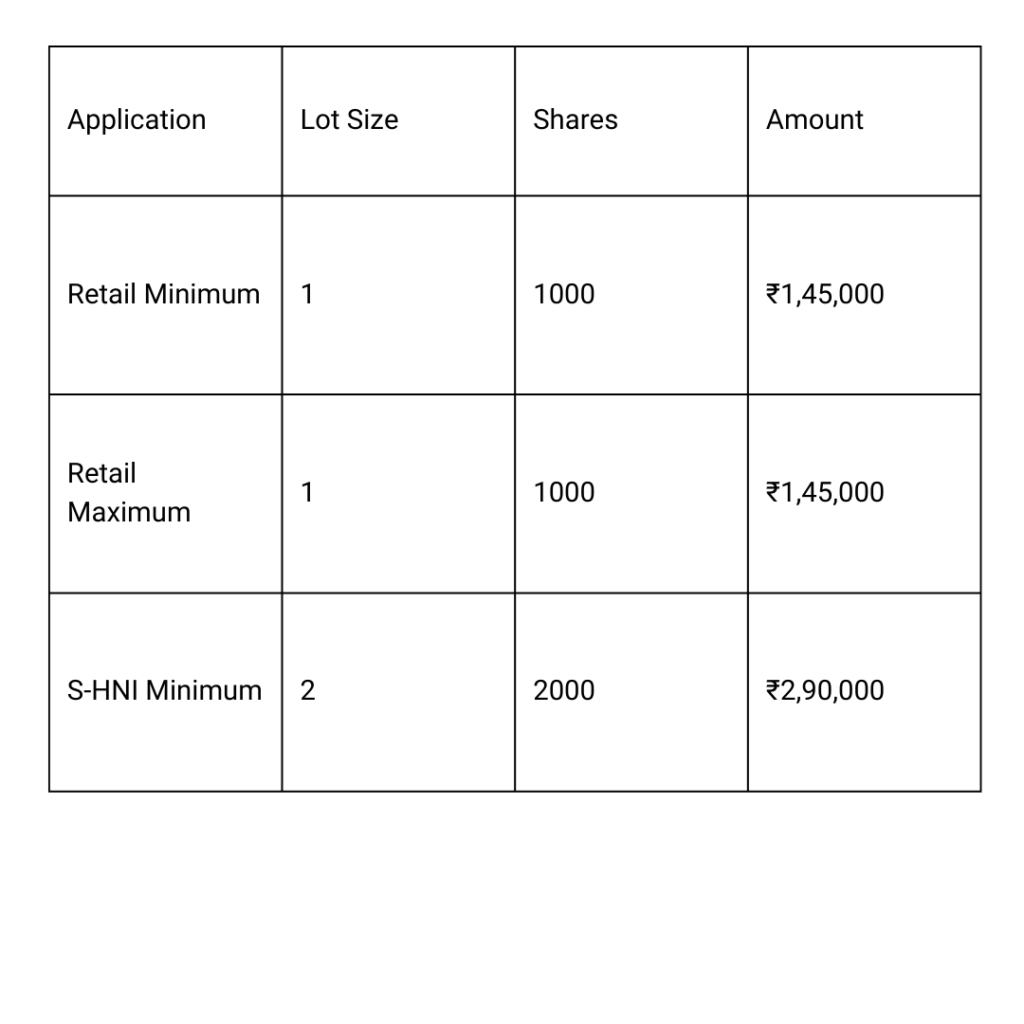

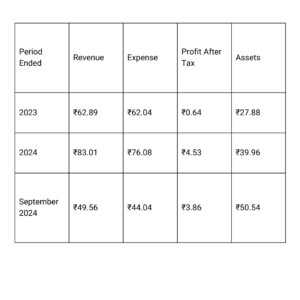

The Rexpro Enterprises IPO, a Fixed Price Issue, is set to open on January 22, 2025, and close on January 24, 2025, with a listing date on the NSE scheduled for January 29, 2025. The IPO aims to raise ₹53.65 crores, comprising a fresh issue of ₹47.13 crores and an offer for sale of 4,50,000 equity shares with a face value of ₹10 each. Priced at ₹145 per share, the issue allocates 50% for retail investors and 50% for high-net-worth individuals (HNIs), with no quota for qualified institutional buyers (QIBs). The company has demonstrated strong financial growth, with revenue increasing from ₹62.89 crores in FY 2023 to ₹83.01 crores in FY 2024, and profits surging from ₹0.64 crores to ₹4.53 crores in the same period. This significant improvement in financial performance indicates a promising long-term investment opportunity. With allotment scheduled for January 27, 2025, the IPO is an attractive option for retail and HNI investors seeking sustained returns, despite the absence of QIB participation.

Rexpro Enterprises IPO Date, Price Details

More About Rexpro Enterprises IPO

Rexpro Enterprise Limited, established in March 2012, is a rapidly growing manufacturing company specializing in fulfilling the furniture and fixture requirements of its clients. Catering to retail sectors such as fashion, lifestyle, electronics, grocery, beauty, and telecom, the company provides innovative solutions to meet diverse needs. Rexpro has also collaborated with top global brands and leading Indian retailers to design and build standalone stores, shop-in-shops, kiosks, and displays. Leveraging its multi-material manufacturing expertise, the company has expanded its operations to produce furniture for offices, hospitals, government establishments, and residential spaces. Additionally, Rexpro has ventured into the infrastructure sector by manufacturing sound barriers to control noise pollution, with installations on Mumbai flyovers. The company has also showcased its engineering capabilities by producing high-precision double doors for Metro platforms, enhancing safety and preventing accidents. As of September 2024, Rexpro employs 65 permanent staff members and 126 contract workers, reflecting its steady growth and commitment to innovation.

Rexpro Enterprises IPO Dates

Rexpro Enterprises IPO Market Lot

Rexpro Enterprises IPO Company All Financial Report

Rexpro Enterprises IPO Company All Financial Analysis

- The Return on Equity (ROE) stands at 56.24%.

- The Return on Capital Employed (ROCE) is 62.21%.

- The EBITDA Margin is 9.71%.

- The Profit After Tax (PAT) Margin is 6.25%.

- The Debt-to-Equity Ratio is 0.65.

- The Earnings Per Share (EPS) (basic) is ₹5.69.

- The Price-to-Earnings (P/E) Ratio is 25.48.

- The Return on Net Worth (RoNW) is 56.24%.

- The Net Asset Value (NAV) is ₹11.58.