Kabra Jewels IPO

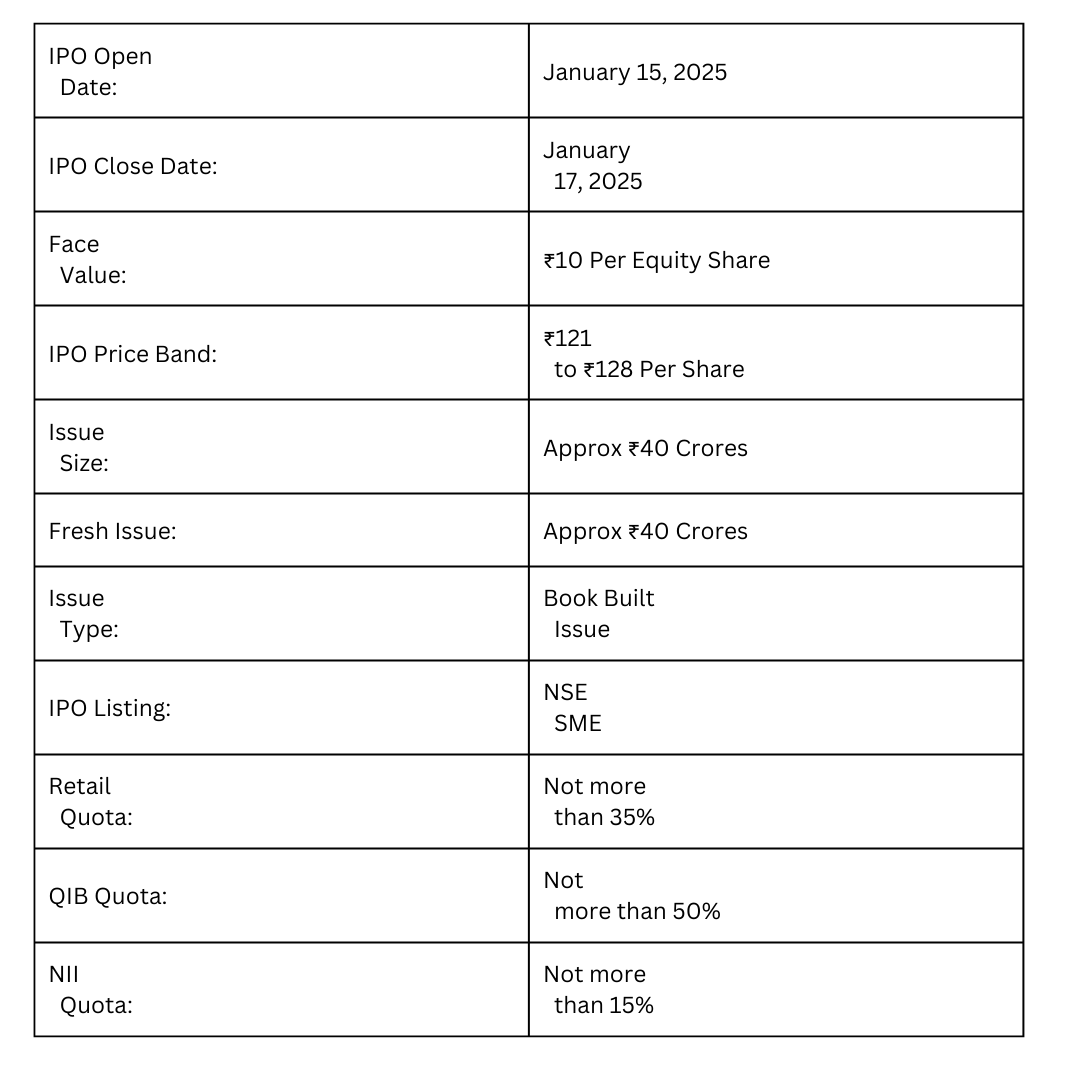

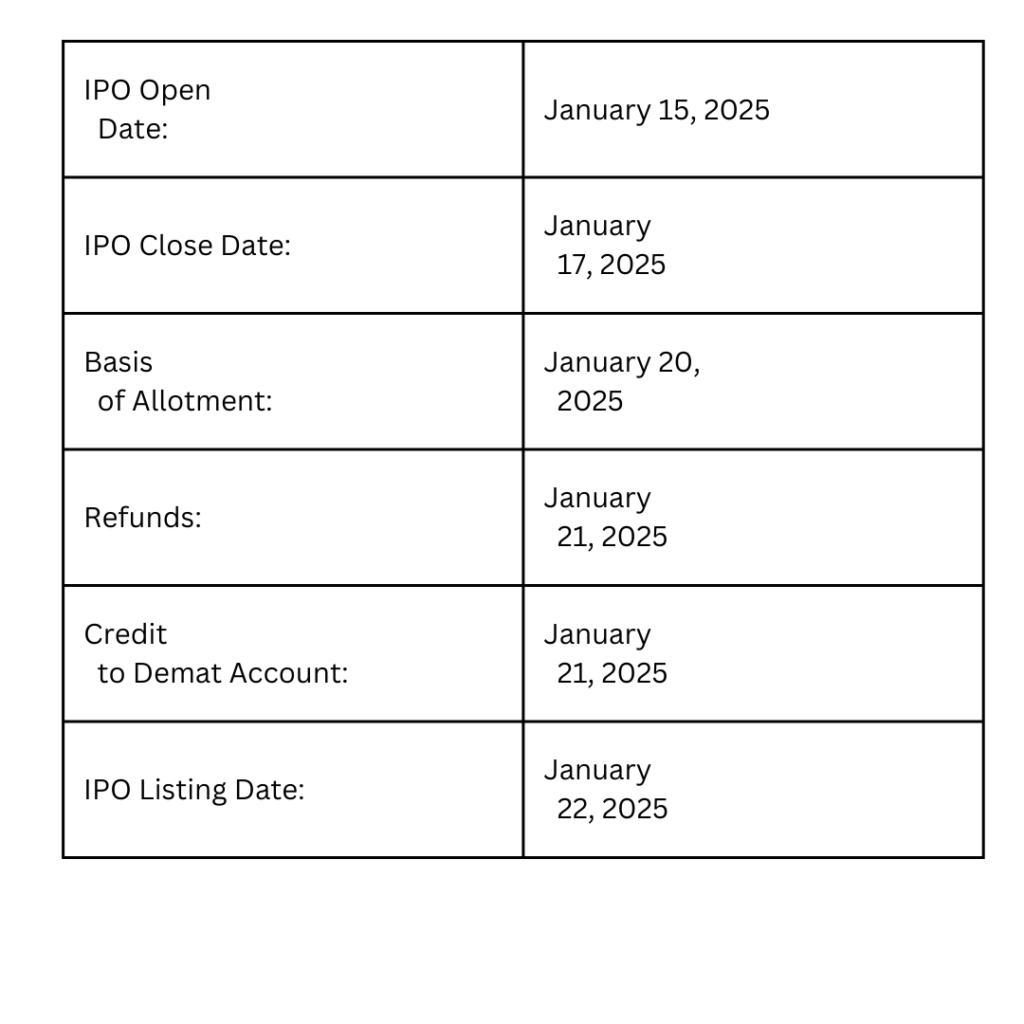

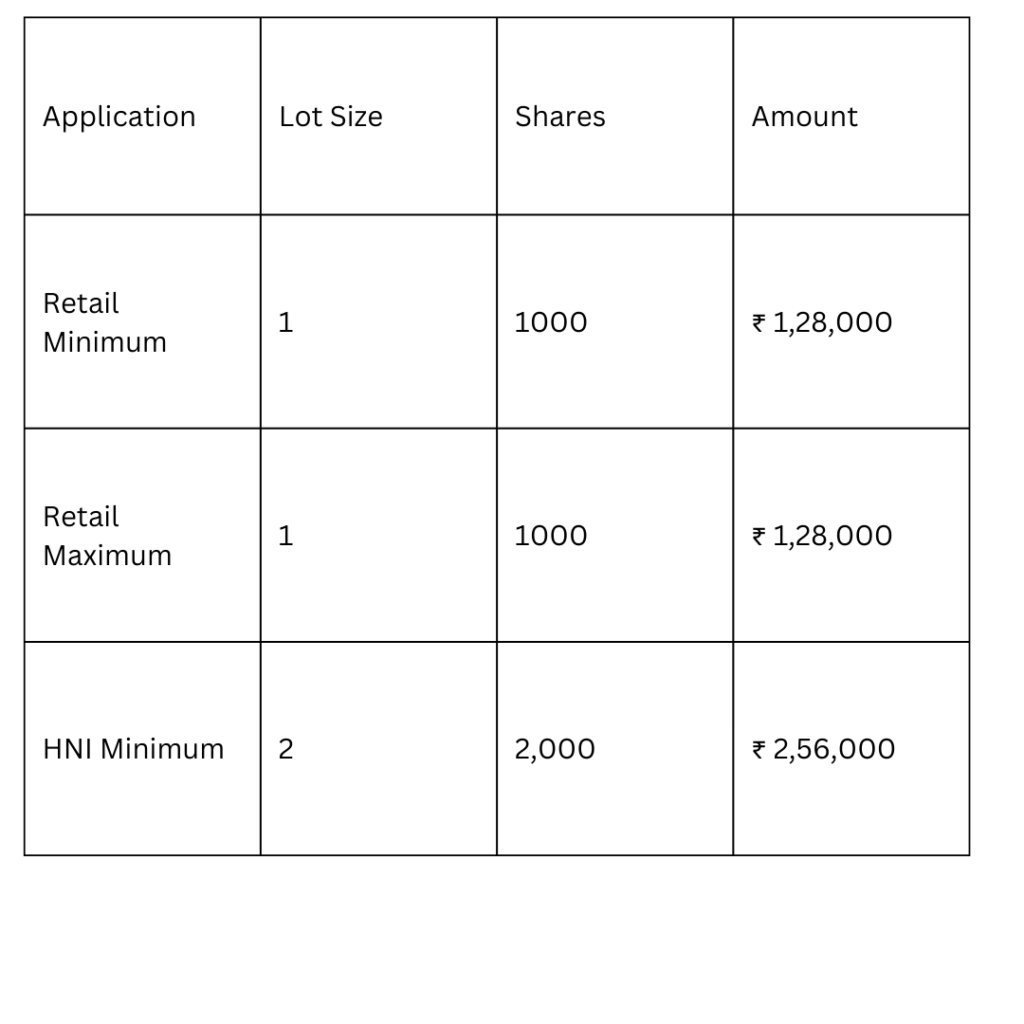

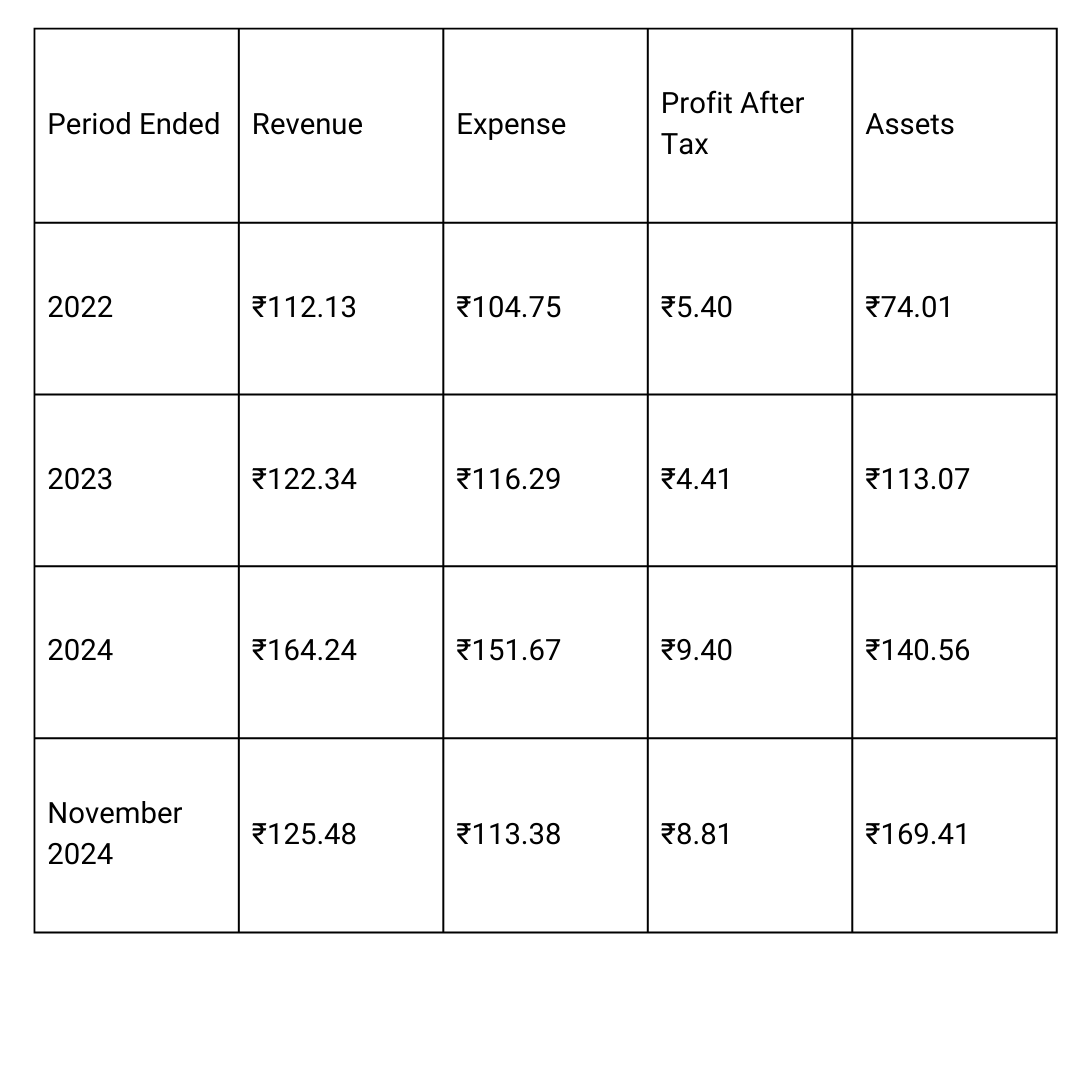

Kabra Jewels IPO is set to open on January 15, 2025, and close on January 17, 2025, as a Book Built Issue aiming to raise approximately ₹40 crores, comprising a fresh issue of ₹40 crores alongside an unspecified offer for sale. The price band for the IPO is set at ₹121 to ₹128 per share, with a face value of ₹10 per equity share. The allocation is divided into 35% for retail investors, 50% for Qualified Institutional Buyers (QIBs), and 15% for High Net-worth Individuals (HNIs). The allotment date is scheduled for January 20, 2025, with the listing expected on the NSE on January 22, 2025. The company reported strong financial growth, with revenue increasing from ₹122.34 crores in FY 2023 to ₹164.24 crores in FY 2024 and profits rising from ₹4.41 crores to ₹9.40 crores in the same period. Based on its financial performance, Kabra Jewels IPO appears to be a promising option for long-term investors.

Kabra Jewels IPO Date, Review, Price, Allotment Details

More About Kabra Jewels IPO

Kabra Jewels Private Limited is a non-government company established on July 21, 2010, specializing in the manufacturing and trading of gold and diamond jewelry. Their product range includes jadau (antique jewelry) crafted with vilandi and precious stones, making it ideal for bridal collections.

The company operates five showrooms in Gujarat and primarily caters to retail customers. Under its K.K. Jewels brand, the company offers a wide selection of gold and diamond jewelry and also sells loose solitaires through its sub-brand, “Only Solitaire.”

Kabra Jewels provides jewelry for various occasions, with wedding jewelry being its best-selling category. Additionally, it offers daily-wear jewelry and focuses on high-value bridal collections, including Gold Jadtar, Diamond, and Polki Meena jewelry. One of its stores is dedicated exclusively to silver jewelry.

From a financial perspective, Kabra Jewels Private Limited has achieved a revenue of ₹164.24 crore, with a Profit After Tax (PAT) of ₹9.39 crore.

Kabra Jewels IPO Date

Kabra Jewels IPO Market Lot

Kabra Jewels IPO Company All Financial Report

Amount ₹ in Crores

Kabra Jewels IPO Company All Financial Analysis

Analysis

Profitability:

- The ROE of 30.25% indicates strong shareholder returns.

- The PAT margin of 5.73% is moderate but reflects improved profitability compared to previous years.

Efficiency:

- The ROCE of 18.23% highlights efficient capital utilization.

- The EBITDA margin of 13.31% suggests effective operational cost control.

Leverage:

- The debt-to-equity ratio of 2.90 indicates a high reliance on debt financing, which could impact financial stability in the long term.

Earnings and Valuation:

- With an EPS of ₹67.93, the company demonstrates robust per-share profitability.

- The NAV of ₹42.20 suggests a reasonable valuation benchmark for investors.

Concluding Remarks

Kabra Jewels has shown substantial growth in revenue and profit, driven by efficient operations and capital management. However, the high debt-to-equity ratio warrants close monitoring. The company’s performance metrics like ROE and EPS position it as a potentially attractive investment in the jewelry sector. Investors may consider these aspects alongside the IPO pricing and industry trends before making decisions.