GB Logistics IPO

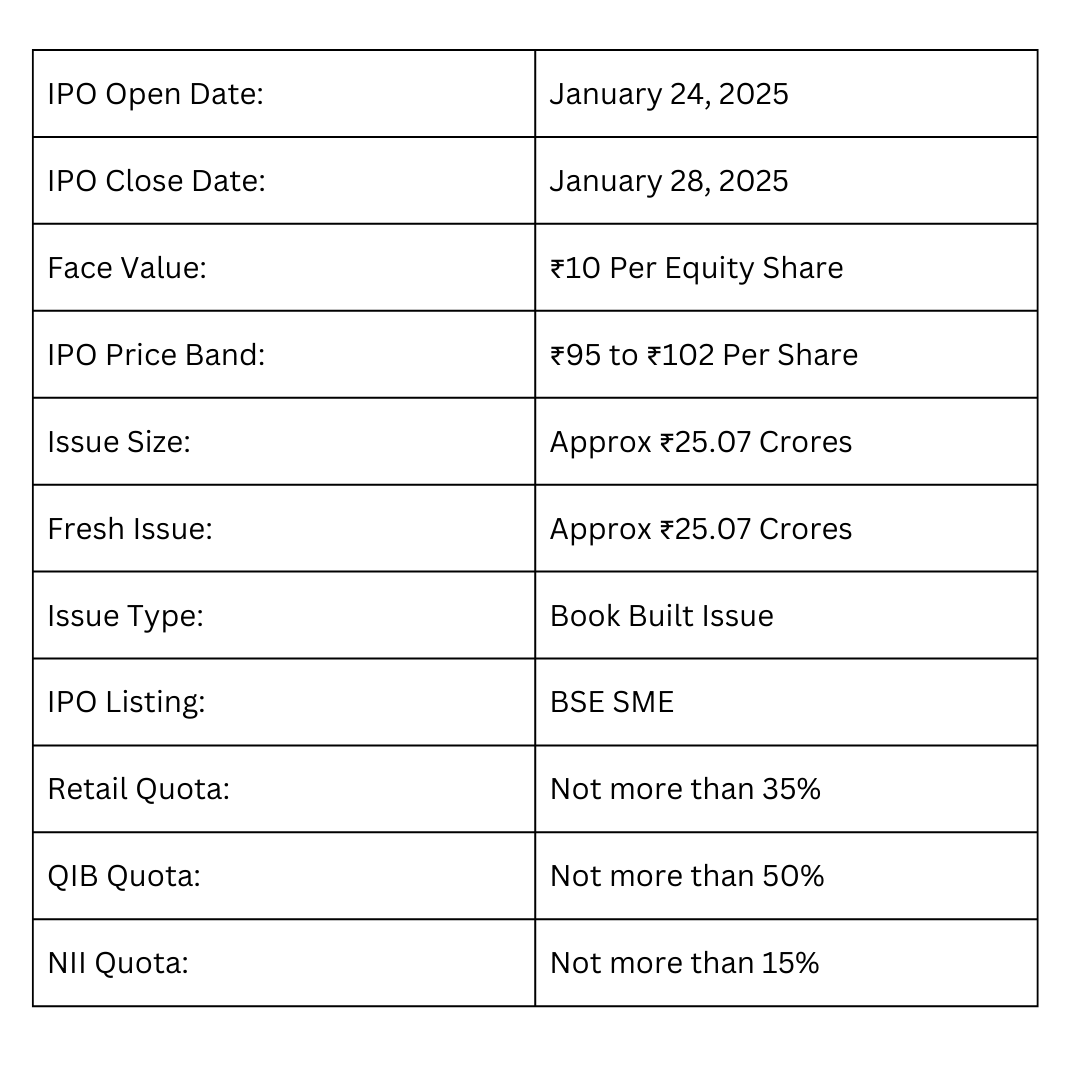

The GB Logistics IPO is scheduled to open on January 24, 2025, and close on January 28, 2025. This is a Book Built Issue aiming to raise ₹25.07 crores, comprising a fresh issue of ₹25.07 crores and an offer for sale (details of shares are not provided). The price band for the IPO is set between ₹95 and ₹102 per share, with a face value of ₹10 per share. The allocation includes a 35% quota for retail investors, 50% for qualified institutional buyers (QIB), and 15% for high net-worth individuals (HNI). The allotment date is January 29, 2025, with the listing expected on the BSE on January 31, 2025. Financially, the company reported a revenue of ₹115.63 crores and a profit of ₹4.86 crores for the fiscal year 2024. Considering the company’s performance, this IPO is recommended for long-term investment.

GB Logistics IPO Details

More About GB Logistics IPO

GB Commerce Limited is a reputable company in the logistics industry, known for its efficient and reliable services. Established in 2019, the company has built a solid reputation by providing high-quality transportation solutions across various industries.

The firm prides itself on offering:

- Qualified and reliable drivers

- A well-maintained fleet of vehicles

- Adaptable, fast, and dependable services

To ensure operational efficiency and customer satisfaction, GB Commerce Limited utilizes its own fleet alongside resources from trusted partners. This approach guarantees reliable and timely services, strengthening customer trust.

The company operates in two key segments:

Logistics:

- Full Truck Load (FTL) services

- Specialized handling and transportation

- Door-to-door delivery services, including deliveries to upper floors

- Expertise in servicing remote and hard-to-reach areas (Out of Delivery Area shipments)

Trading in Agricultural Commodities:

- Incidental trading opportunities to diversify revenue streams

With a dedicated team of 39 full-time staff members, GB Commerce Limited consistently delivers outstanding performance in both logistics and trading, ensuring a seamless customer experience in even the most challenging circumstances.

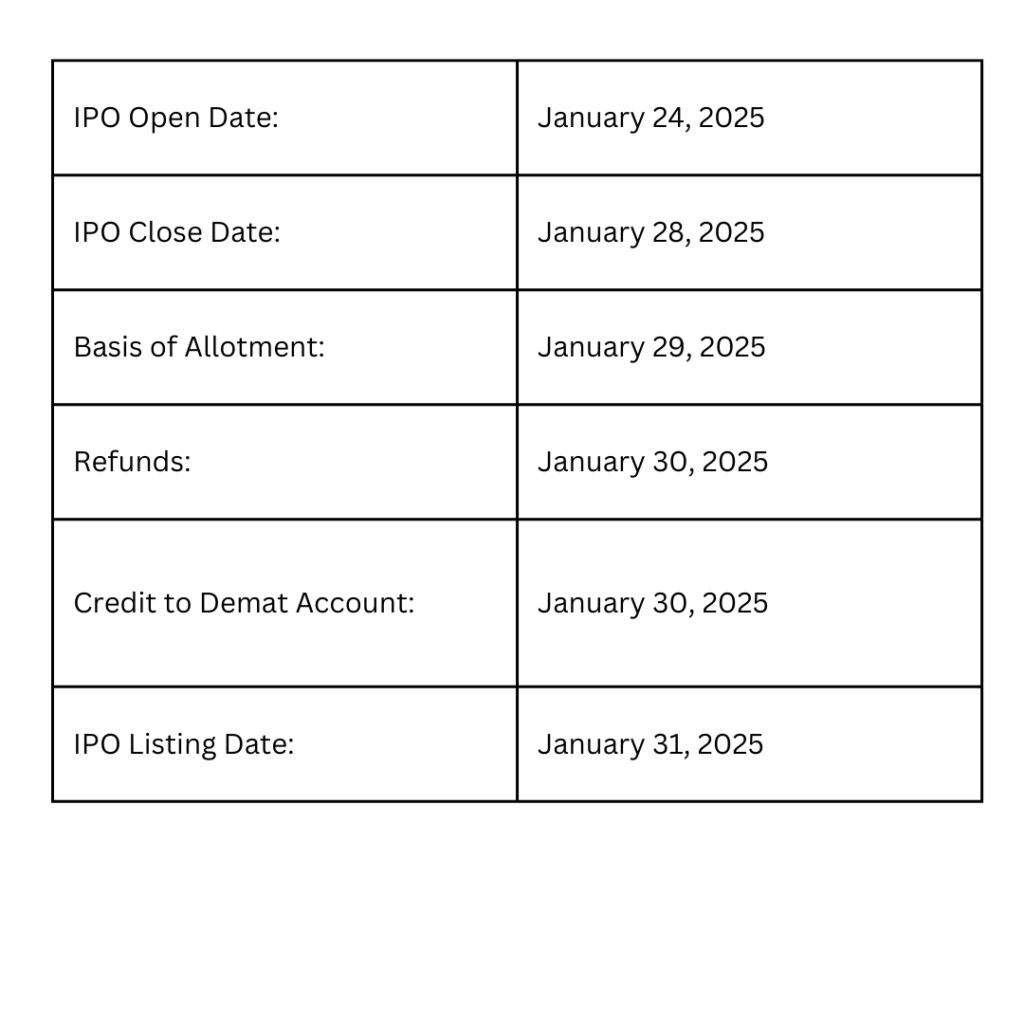

GB Logistics IPO Dates

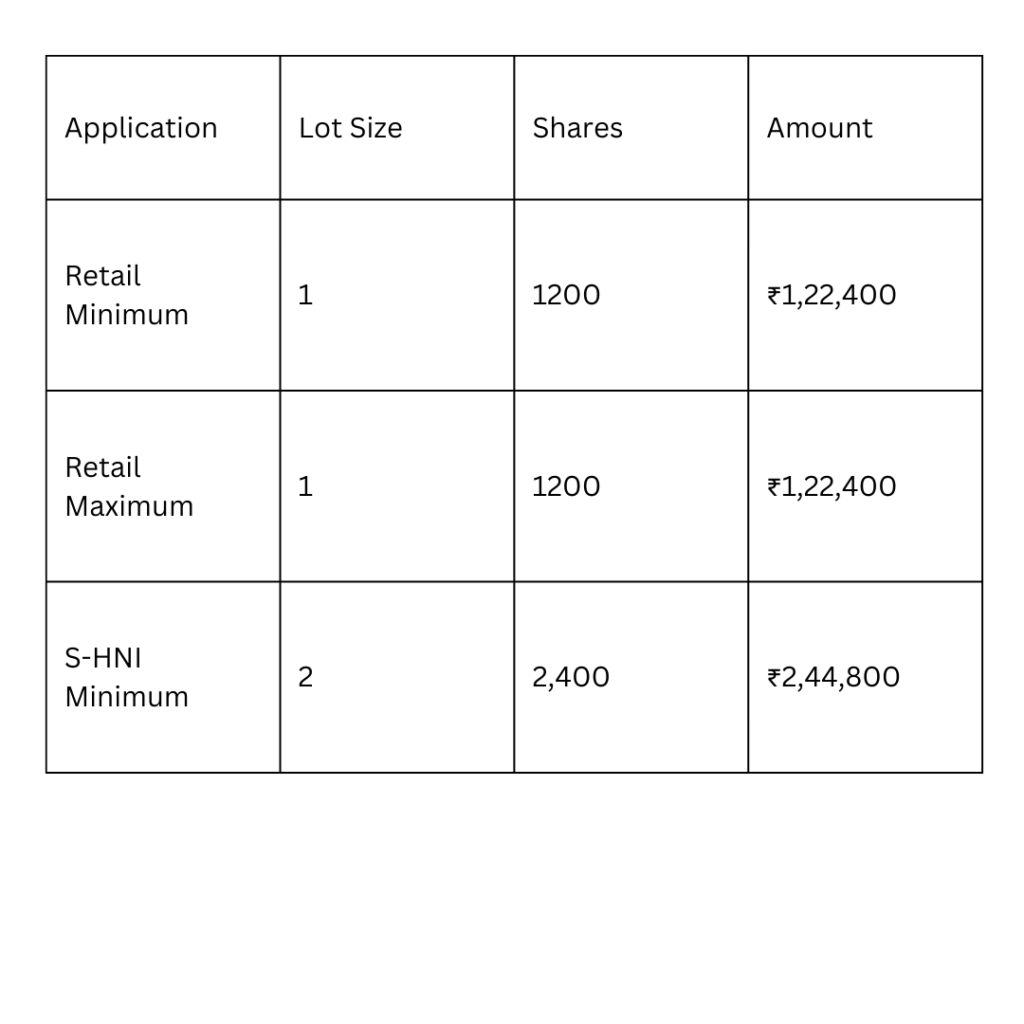

GB Logistics IPO Market Lot

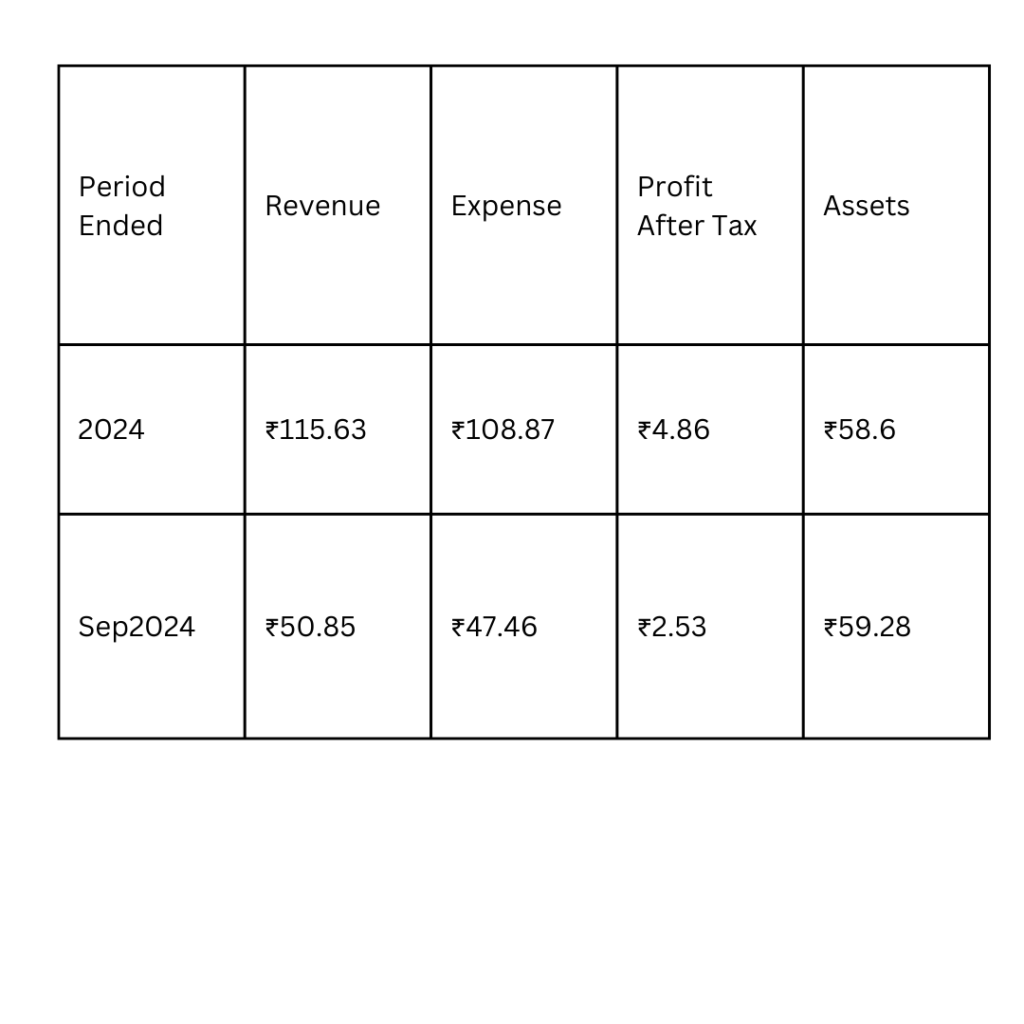

GB Logistics IPO Company All Financial Report

Amount ₹ in Crores

GB Logistics IPO Company All Financial Analysis

ROE (Return on Equity) – 27.36%

- A high ROE indicates the company effectively generates profits relative to shareholders’ equity. It’s a positive sign of profitability.

ROCE (Return on Capital Employed) – 14.51%

- ROCE measures how efficiently the company uses its capital to generate returns. A 14.51% ROCE shows moderate efficiency.

EBITDA Margin – 8.01%

- The EBITDA margin indicates the company’s operating efficiency. While an 8.01% margin is acceptable, this will depend on the industry benchmark.

PAT (Profit After Tax) Margin – 4.21%

- A 4.21% PAT margin indicates the company retains ₹4.21 as net profit for every ₹100 in revenue. This suggests moderate profitability, but comparisons with peers are needed.

Debt to Equity Ratio – 0.88

- A ratio of 0.88 is reasonable, indicating the company is not heavily leveraged. It suggests a balanced use of debt and equity for financing.

EPS (Earnings Per Share) – ₹8.48 (Basic)

- A healthy EPS figure shows the company’s earnings distributed to shareholders. It’s critical for gauging profitability from an investor’s perspective.

P/E Ratio – N/A

- Since the P/E ratio is unavailable, it’s unclear how the market perceives the company relative to its earnings. It may also indicate the company is unlisted or newly listed.

RoNW (Return on Net Worth) – 27.36%

- Matches the ROE, emphasizing the company’s strong net profitability.

NAV (Net Asset Value) – ₹30.98

- NAV is a measure of the company’s per-share book value. Comparing it to the market price (if listed) gives insights into valuation.

Key Insights

- The ROE and RoNW are excellent indicators of strong profitability.

- A Debt-to-Equity ratio of 0.88 shows prudent financial management.

- The absence of a P/E ratio suggests limited valuation insight, potentially due to unavailability or market dynamics.