Dr. Agarwals IPO

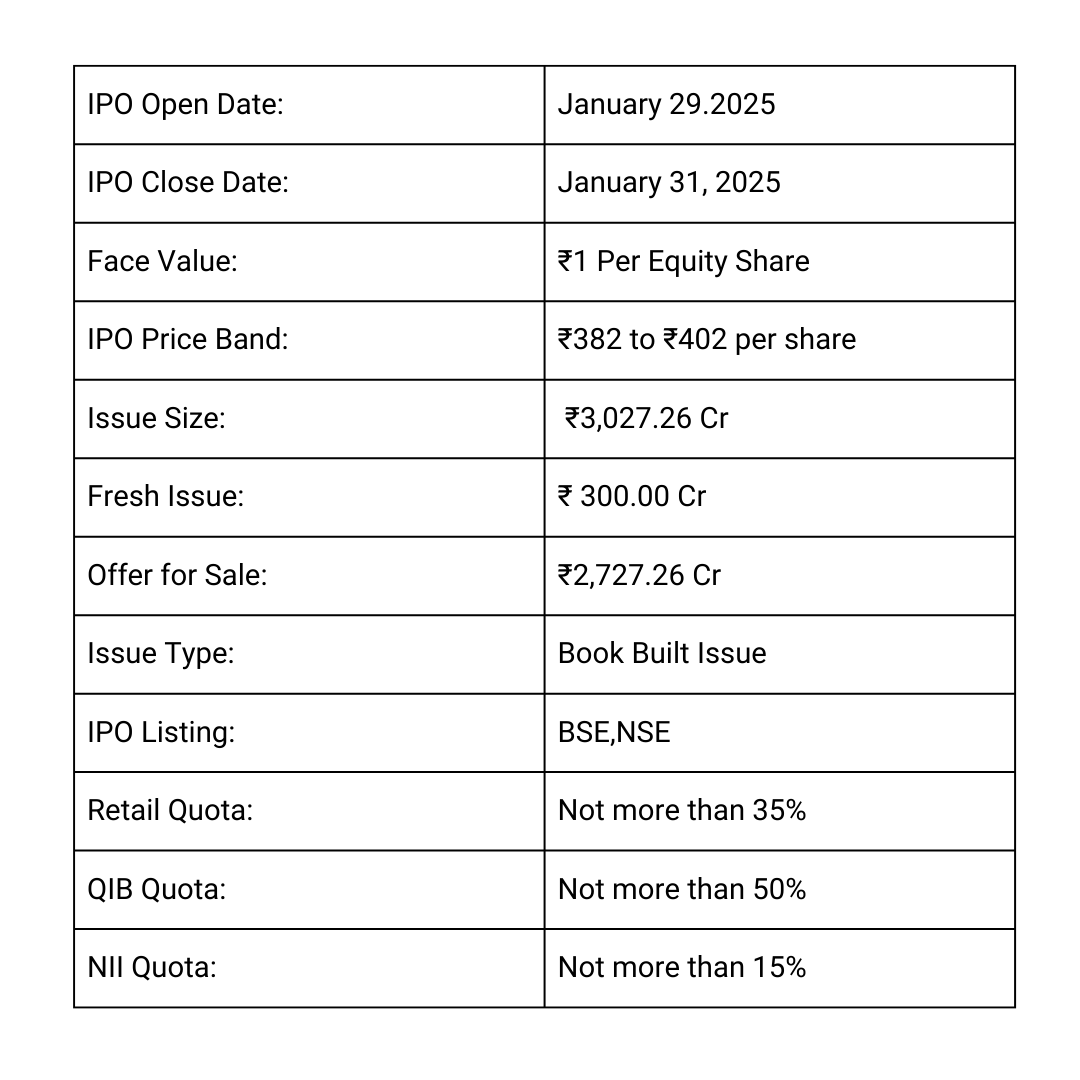

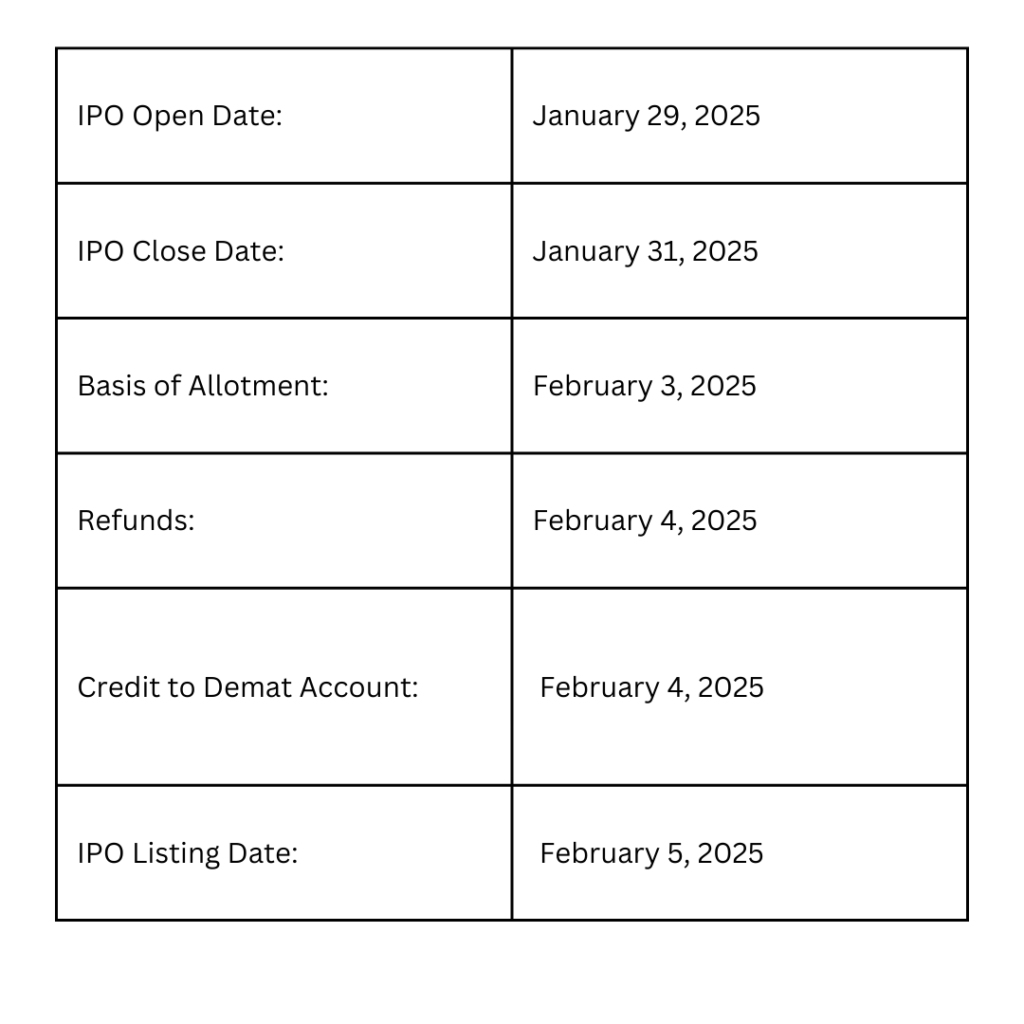

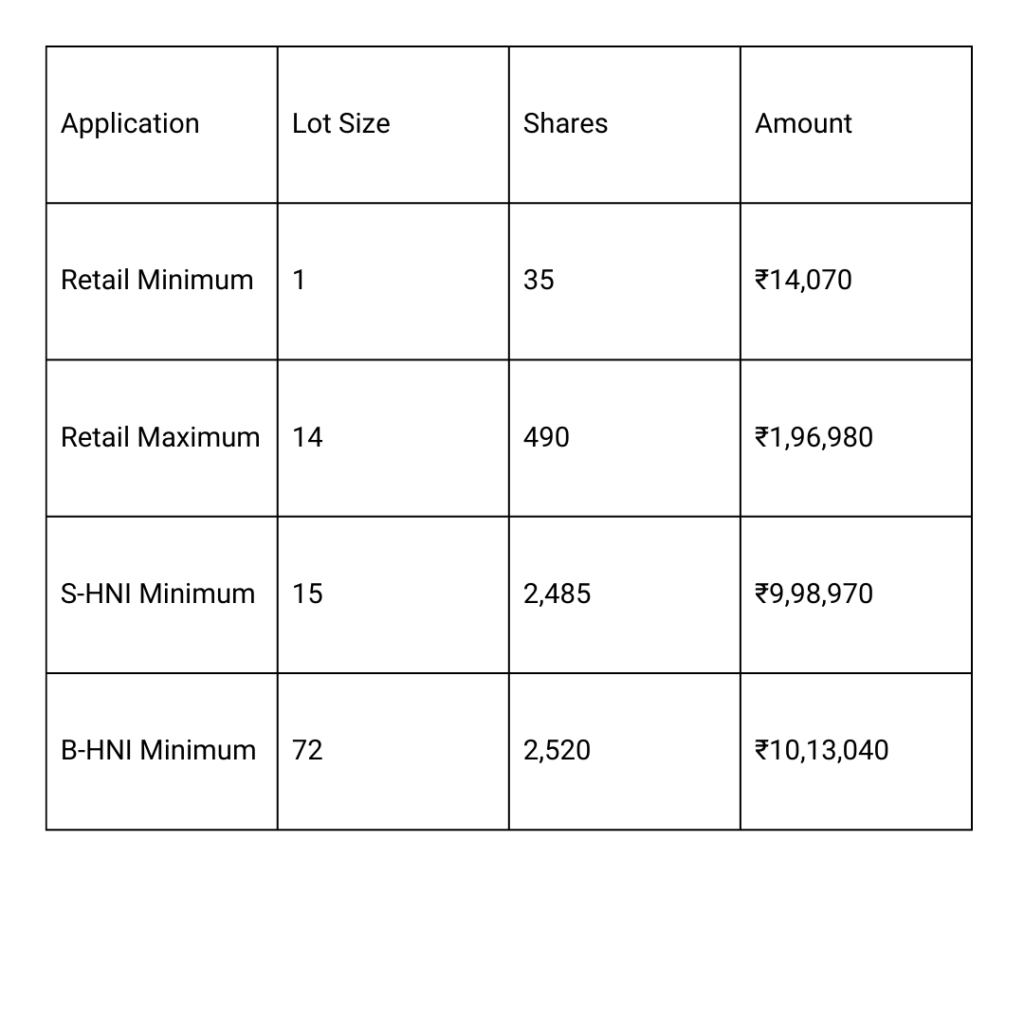

Dr. Agarwal’s IPO is set to open for subscription from January 29 to January 31, 2025, with a total issue size of ₹3,027.26 crores. This includes a fresh issue of ₹300 crores (0.75 crore shares) and an offer for sale of ₹2,727.26 crores (6.78 crore shares). The IPO price band is fixed at ₹382 to ₹402 per share, with a minimum lot size of 35 shares, requiring a retail investor to invest at least ₹14,070. For small non-institutional investors (sNII), the minimum investment is 15 lots (525 shares) amounting to ₹2,11,050, while for big non-institutional investors (bNII), it is 72 lots (2,520 shares) totaling ₹10,13,040. The allotment of shares is expected to be finalized on February 3, 2025, with a tentative listing date of February 5, 2025, on the BSE and NSE.

Dr Agarwals IPO Details

More About Dr Agarwals IPO

Incorporated in 2010, Dr. Agarwal’s Health Care Limited provides a comprehensive range of eye care services, including cataract and refractive surgeries, consultations, diagnostics, non-surgical treatments, and the sale of optical products, contact lenses, accessories, and eye care-related pharmaceutical items. As of September 30, 2024, the company employed 737 doctors across its facilities, serving 2.13 million patients and performing 220,523 surgeries during the year. In the six months leading up to September 30, 2024, they served 1.15 million patients and conducted 140,787 surgeries.

Dr Agarwals IPO Dates

Dr Agarwals Healthcare IPO Lot Size

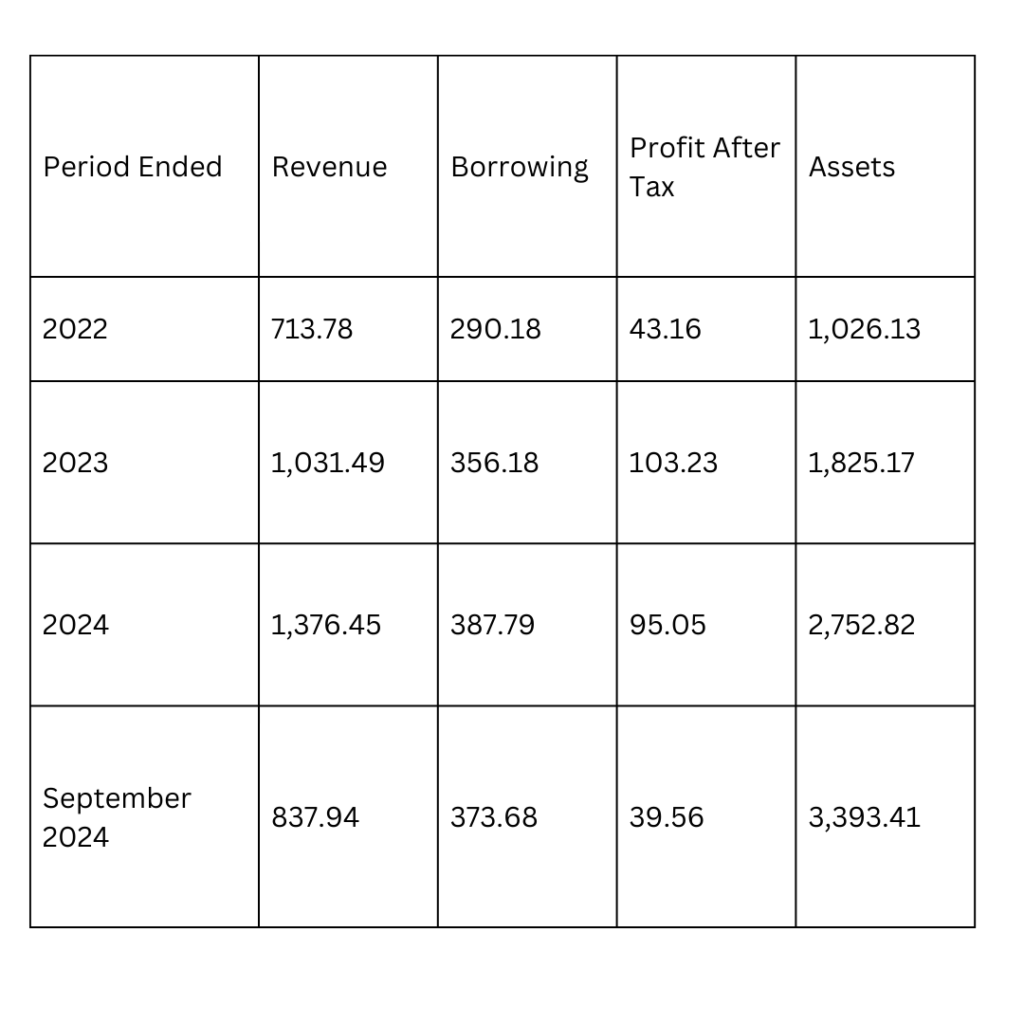

Dr. Agarwals IPO Company All Financial Report

Amount ₹ in Crores

Dr. Agarwals IPO Company All Financial Analysis

ROE (Return on Equity): 9.33%

- Measures profitability relative to shareholders’ equity.

- Indicates how effectively a company uses equity to generate profit.

ROCE (Return on Capital Employed): 14.61%

- Evaluates the efficiency of capital usage in generating profits.

- A higher ROCE indicates better utilization of capital.

RoNW (Return on Net Worth): 6.21%

- Similar to ROE, reflects the return generated on shareholders’ net worth.

- Lower than ROE could indicate inefficiency or higher retained earnings.

PAT Margin (Profit After Tax Margin): 6.90%

- Shows the percentage of revenue left after all expenses and taxes.

- A useful metric for assessing profitability.

Price to Book Value (P/B Ratio): 7.96

- Compares the market price of the stock to its book value.

- A high P/B ratio may indicate overvaluation or strong investor confidence.