Denta Water IPO

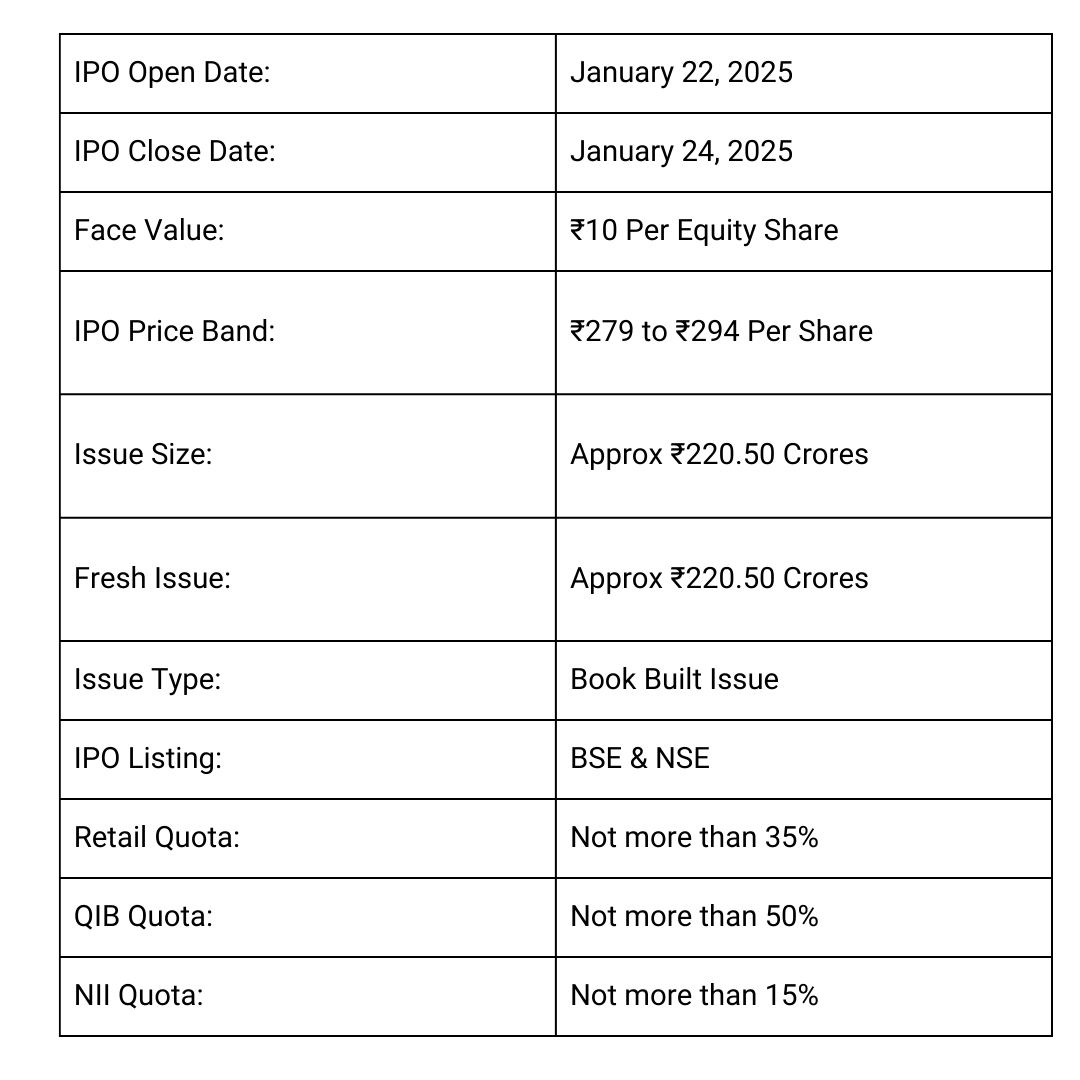

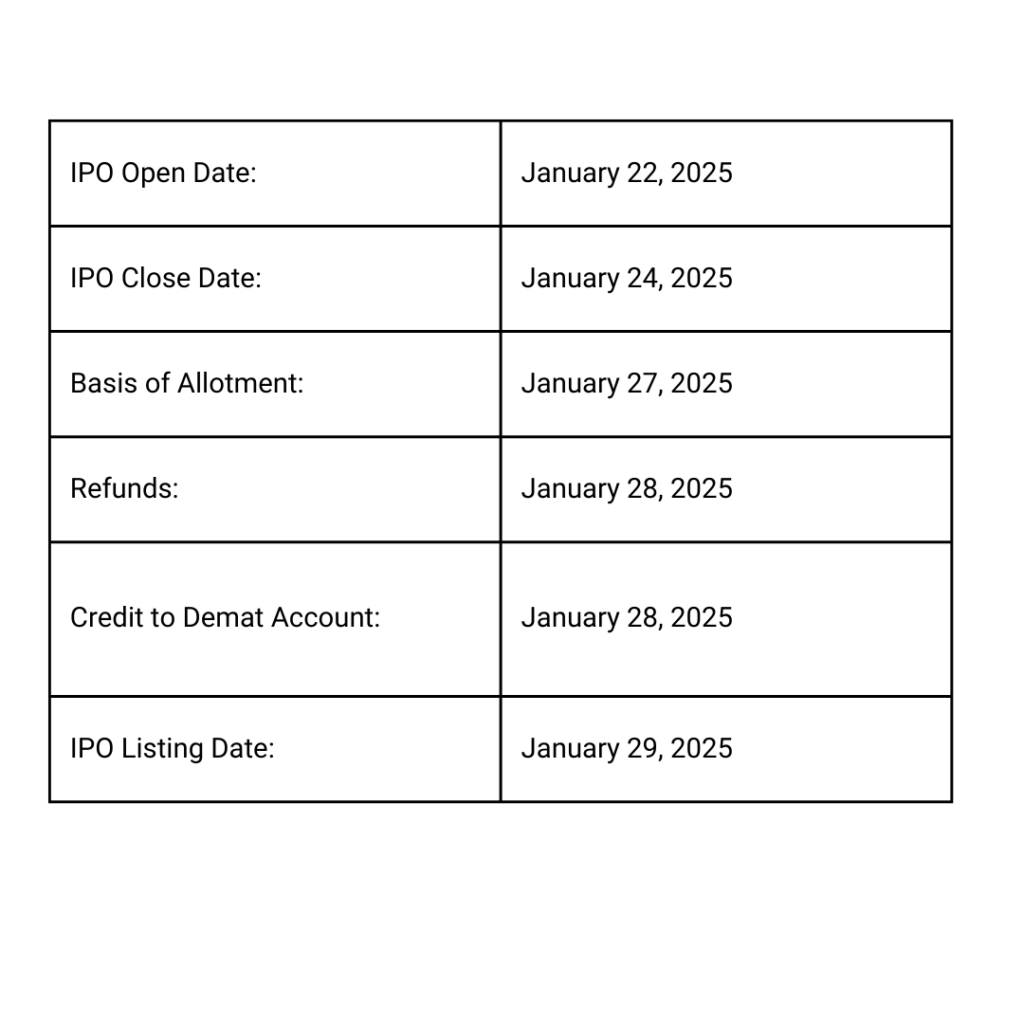

The Denta Water and Infra Solutions IPO is set to open on January 22, 2025, and will close on January 24, 2025. It is a Book Built Issue with a price band of ₹279 to ₹294 per share and a face value of ₹10 per share. The IPO aims to raise ₹220.50 crores, comprising a fresh issue of ₹220.50 crores, while details of the offer for sale are yet to be disclosed. The IPO has a reservation quota of 35% for retail investors, 50% for qualified institutional buyers (QIB), and 15% for high-net-worth individuals (HNI). The shares are scheduled to be listed on the BSE and NSE on January 29, 2025, with the allotment date set for January 27, 2025.

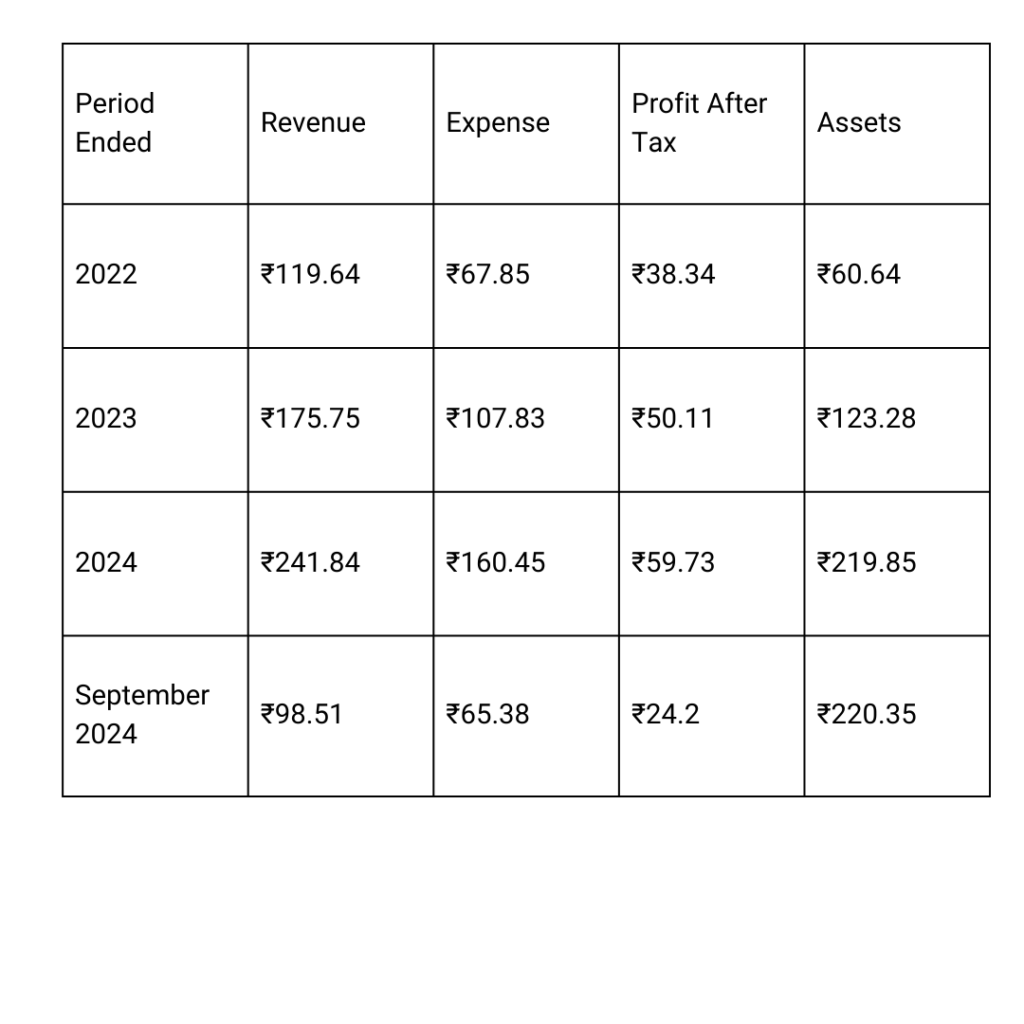

Financially, the company reported a revenue of ₹241.84 crores in FY 2024, up from ₹175.75 crores in FY 2023, and a profit of ₹59.73 crores in FY 2024, compared to ₹50.11 crores in FY 2023. With this strong growth trajectory and plans to utilize the IPO proceeds for expansion, analysts suggest that the IPO could be a promising investment for the long term.

Denta Water IPO Date, Price Details

More About Denta Water IPO

Denta Water and Infra Solution Limited, founded in 2016, is a rapidly growing company in the water and infrastructure sector. Renowned for its expertise in groundwater recharge projects, the company specializes in the design, installation, and commissioning of water infrastructure, as well as the maintenance of such projects for specified periods. Additionally, Denta Water undertakes construction projects in the railway and highway sectors. In response to the increasing demand for water-related solutions in the country, the company has emerged as a key player in addressing water scarcity by installing groundwater recharge systems using recycled water. Some of their successfully completed projects include the Byrapura, Hiremagaluru, and Karagada Lift Irrigation System (LIS). They have also actively contributed to the Government’s Jal Jeevan Mission, demonstrating a strong commitment to water management initiatives. As of November 30, 2024, Denta Water employs 89 permanent staff, reflecting its steady growth and dedication to the sector.

Denta Water IPO Dates

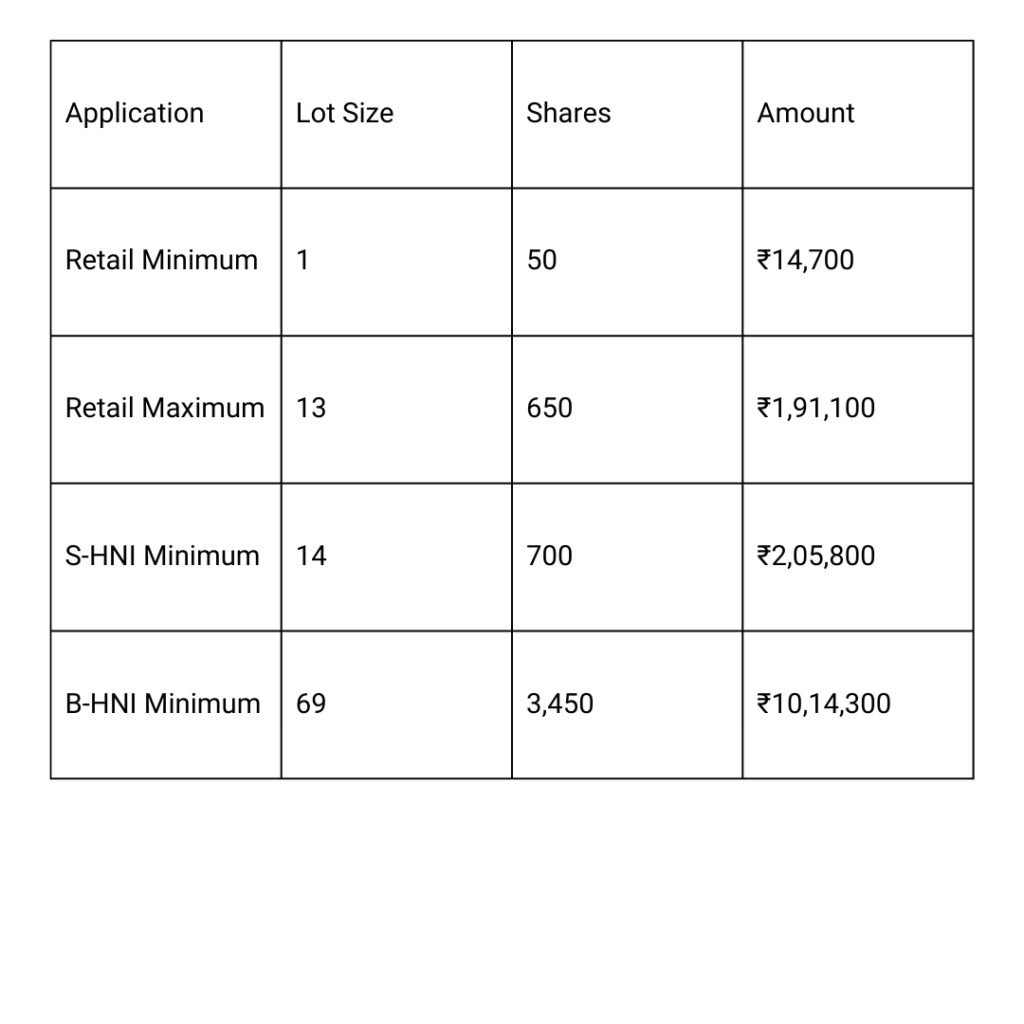

Denta Water IPO Market Lot

Denta Water Company All Financial Report

Amount ₹ in Crores

Denta Water Company All Financial Analysis

Return on Equity (ROE): 36.36%

- Indicates strong profitability relative to shareholder equity. A higher ROE is a positive sign of efficient equity use.

Return on Capital Employed (ROCE): 76.99%

- Reflects excellent returns from the capital employed. It showcases effective utilization of both equity and debt to generate profits.

EBITDA Margin: 33.17%

- Impressive operating profitability, suggesting good cost control and operational efficiency.

PAT Margin: 25.03%

- A healthy net profit margin, showing the company retains a significant portion of its revenue as profit.

Debt to Equity Ratio: 0.01

- Extremely low leverage, indicating minimal reliance on debt for financing, which lowers financial risk.

Earnings Per Share (EPS): ₹31.11 (Basic)

- Solid earnings per share, pointing to strong profitability on a per-share basis.

Price/Earnings (P/E) Ratio: N/A

- P/E is unavailable, possibly because the share price data or earnings trends are not sufficient to calculate it.

Return on Net Worth (RoNW): 36.36%

- Matches the ROE, reaffirming efficient utilization of shareholder equity.

Net Asset Value (NAV): ₹85.55

- Represents the per-share intrinsic value of the company, reflecting strong asset backing.

General Assessment:

The company appears to be in a robust financial position with high profitability margins, efficient use of equity and capital, and minimal debt. The absence of a P/E ratio might suggest a need for further context, such as stock market valuation or other industry specifics.