CLN Energy IPO

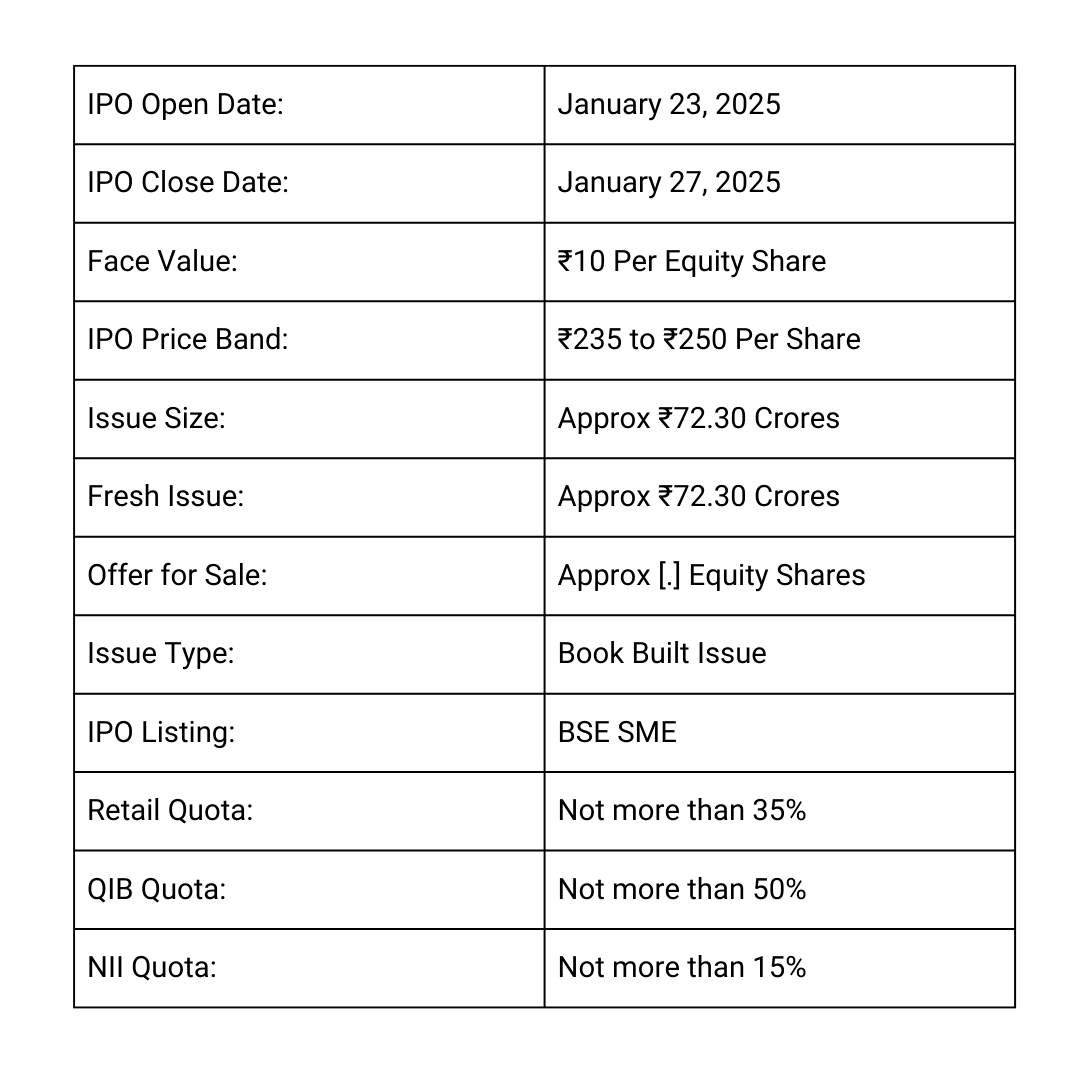

The CLN Energy IPO is scheduled to open on January 23, 2025, and will close on January 27, 2025. It is a Book Built Issue, aiming to raise ₹72.30 crores, comprising a fresh issue of ₹72.30 crores, with details of the offer for sale not disclosed. The IPO price band is set at ₹235 to ₹250 per share, with a face value of ₹10 per share. The retail investor quota is 35%, while Qualified Institutional Buyers (QIB) and High Net-Worth Individuals (HNI) are allocated 50% and 15%, respectively. The allotment date is January 28, 2025, and the shares are expected to be listed on the BSE on January 30, 2025. Financially, the company reported a revenue of ₹132.86 crores in FY 2024, compared to ₹128.88 crores in FY 2023, and a significant increase in profit from ₹0.73 crores in FY 2023 to ₹9.79 crores in FY 2024. Based on its financial growth, the IPO is considered a good opportunity for long-term investment, although investors should assess risks and market conditions.

CLN Energy IPO Details

More About CLN Energy IPO

CLN Energy Limited is renowned for its innovative approach to manufacturing electric components and delivering high-quality solutions for electric vehicles (EVs) and stationary applications such as energy storage systems (ESS) and telecommunications. Established in 2019, the company initially focused on producing lithium-ion batteries and motors. In addition, CLN Energy is actively involved in the sale of electric vehicle components, including DC-DC converters, displays, and differentials.

With a dedicated R&D team, CLN Energy has achieved a 30% contribution to the development of advanced, environmentally sustainable components. The company prioritizes delivering top-notch services at both national and international levels, fostering confidence and achieving exceptional results in the process.

CLN Energy boasts state-of-the-art manufacturing facilities located in Noida (42,000 sq. ft.) and Pune (20,000 sq. ft.), with an annual production capacity exceeding 1 GWh of battery packs and 120,000 motors. These facilities support L2, L3, and L5 vehicle categories, underlining CLN Energy’s commitment to advancing EV technology and driving sustainable solutions.

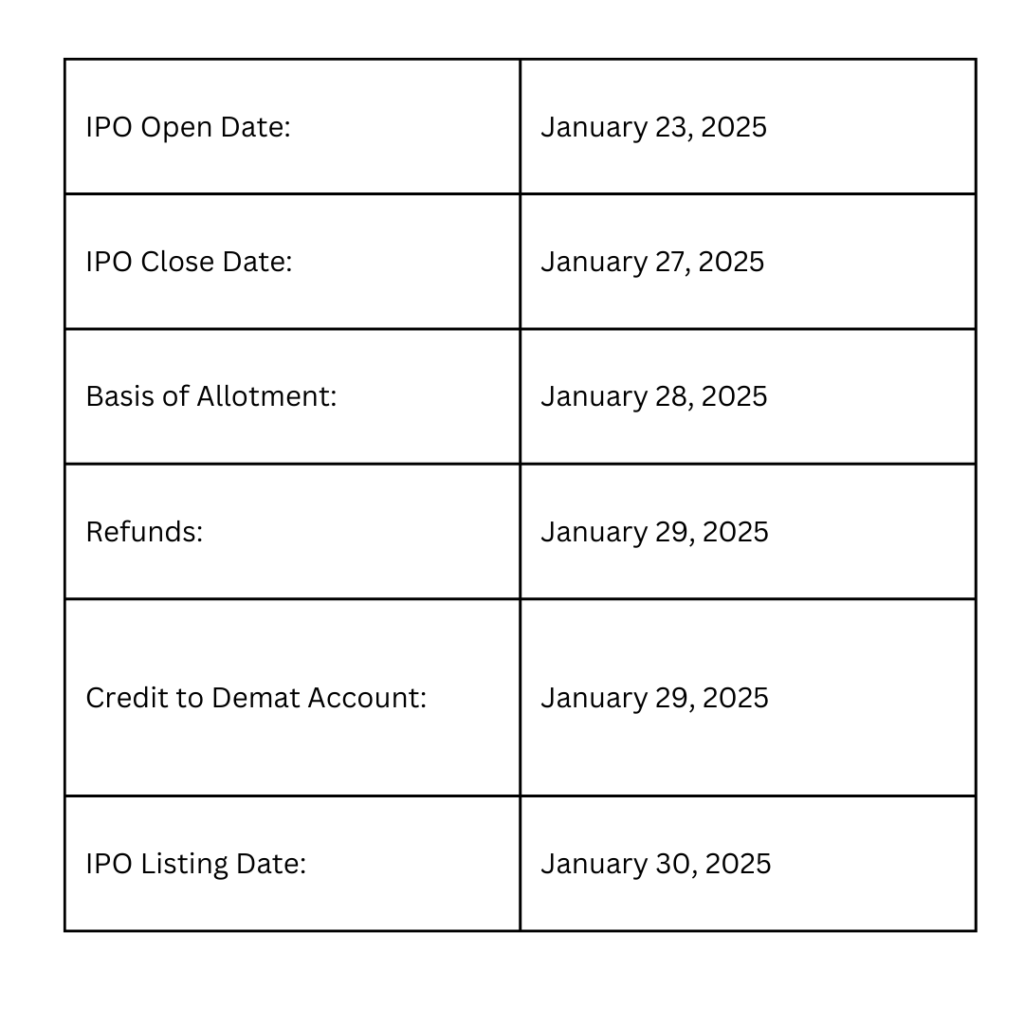

CLN Energy IPO Dates

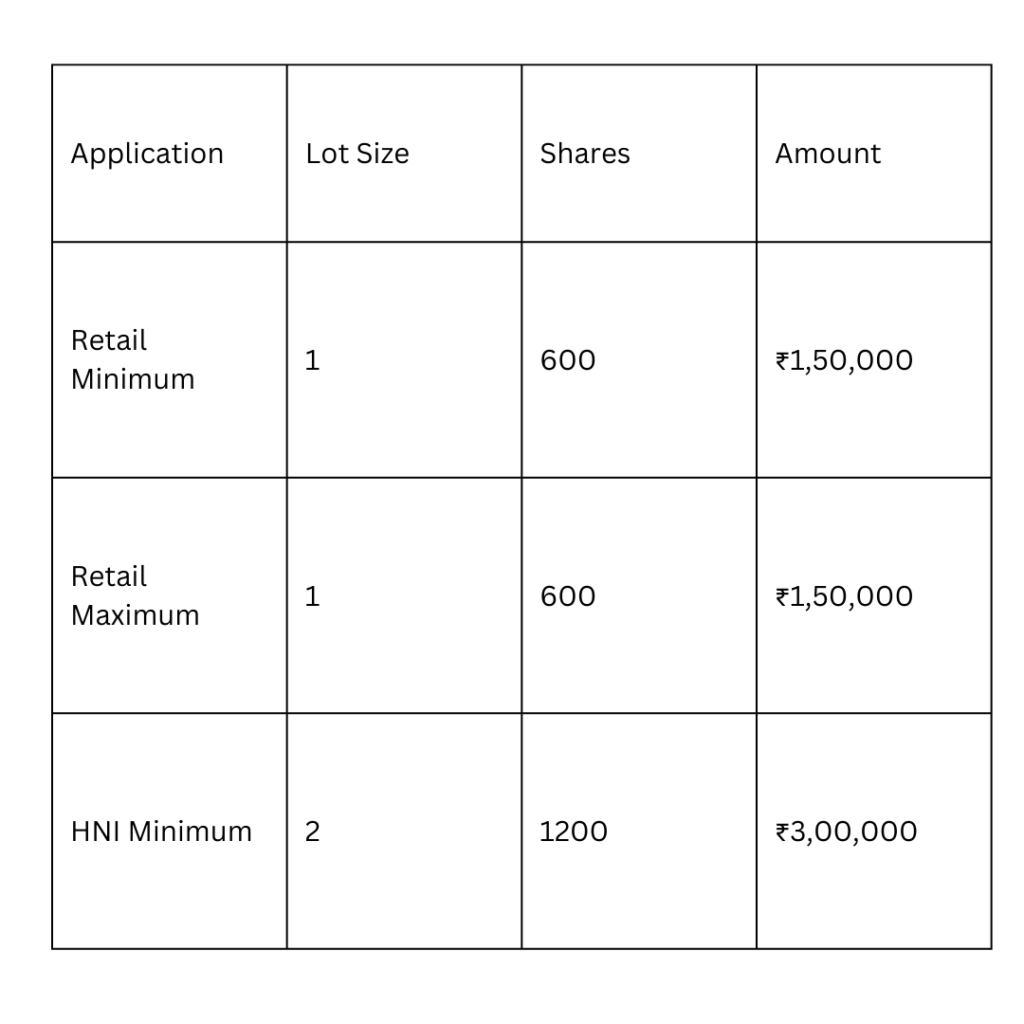

CLN Energy IPO Market Lot

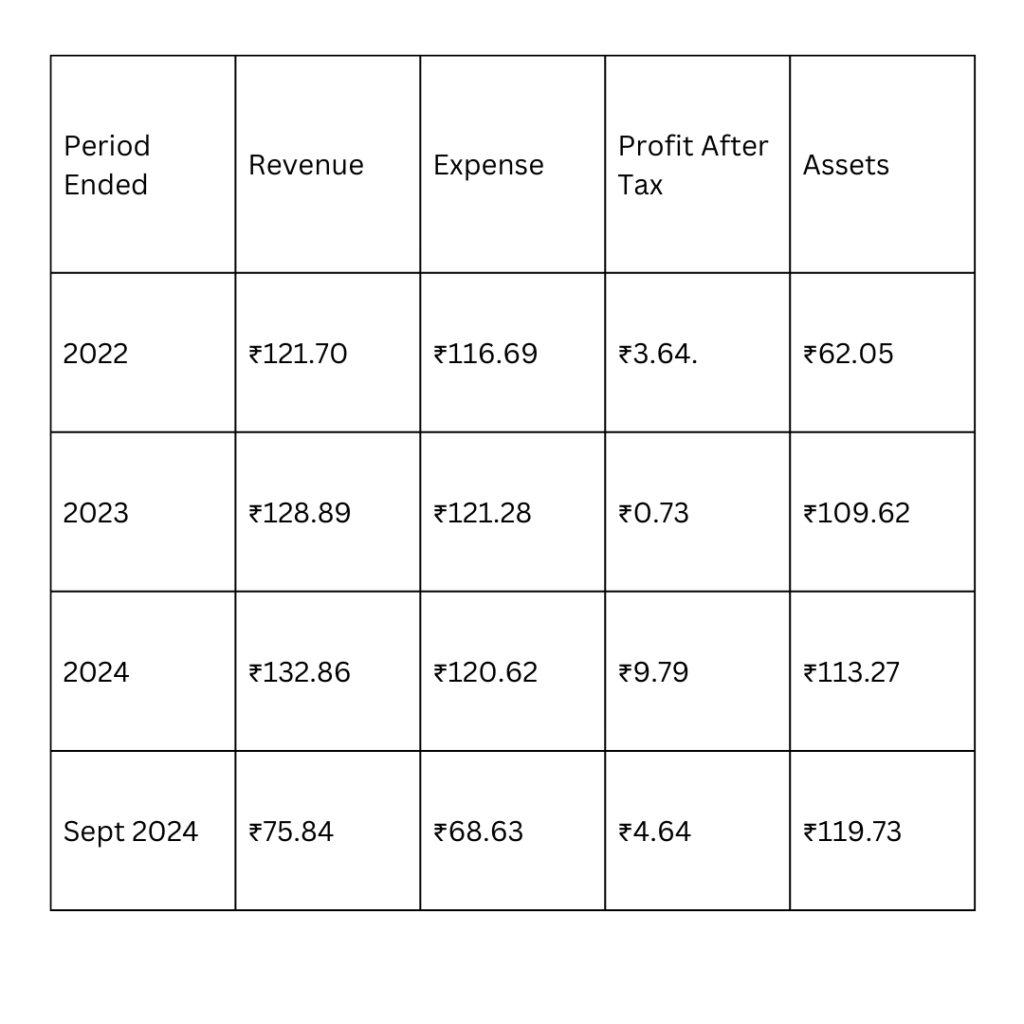

CLN Energy IPO Company All Financial Report

Amount ₹ in Crores

CLN Energy IPO Company All Financial Analysis

- Return on Equity (ROE): 115%

- Return on Capital Employed (ROCE): 91.55%

- Return on Net Worth (RoNW): 73.19%

- PAT Margin: 7.38%

Observations:

- Strong Asset Growth: The company’s total assets have grown significantly over the years, nearly doubling from ₹62.05 Cr in 2022 to ₹119.73 Cr in 2024.

- Revenue Volatility: Revenue has fluctuated, peaking at ₹132.86 Cr in FY2024 but tapering to ₹75.84 Cr in the half-year ending September 2024.

- Improved Profitability: Profit After Tax increased markedly from ₹0.73 Cr in FY2023 to ₹4.64 Cr in H1 FY2024.

- Net Worth Surge: A sharp increase in net worth, from ₹2.86 Cr in 2022 to ₹18.01 Cr in September 2024, suggests substantial reinvestment or earnings retention.

- Leverage: Borrowing figures are only available for the latest period (₹6.78 Cr), indicating the company may have started leveraging debt recently.

- High Returns: Impressive ROE, ROCE, and RoNW ratios signal strong financial efficiency and profitability.