Capital Numbers Infotech IPO

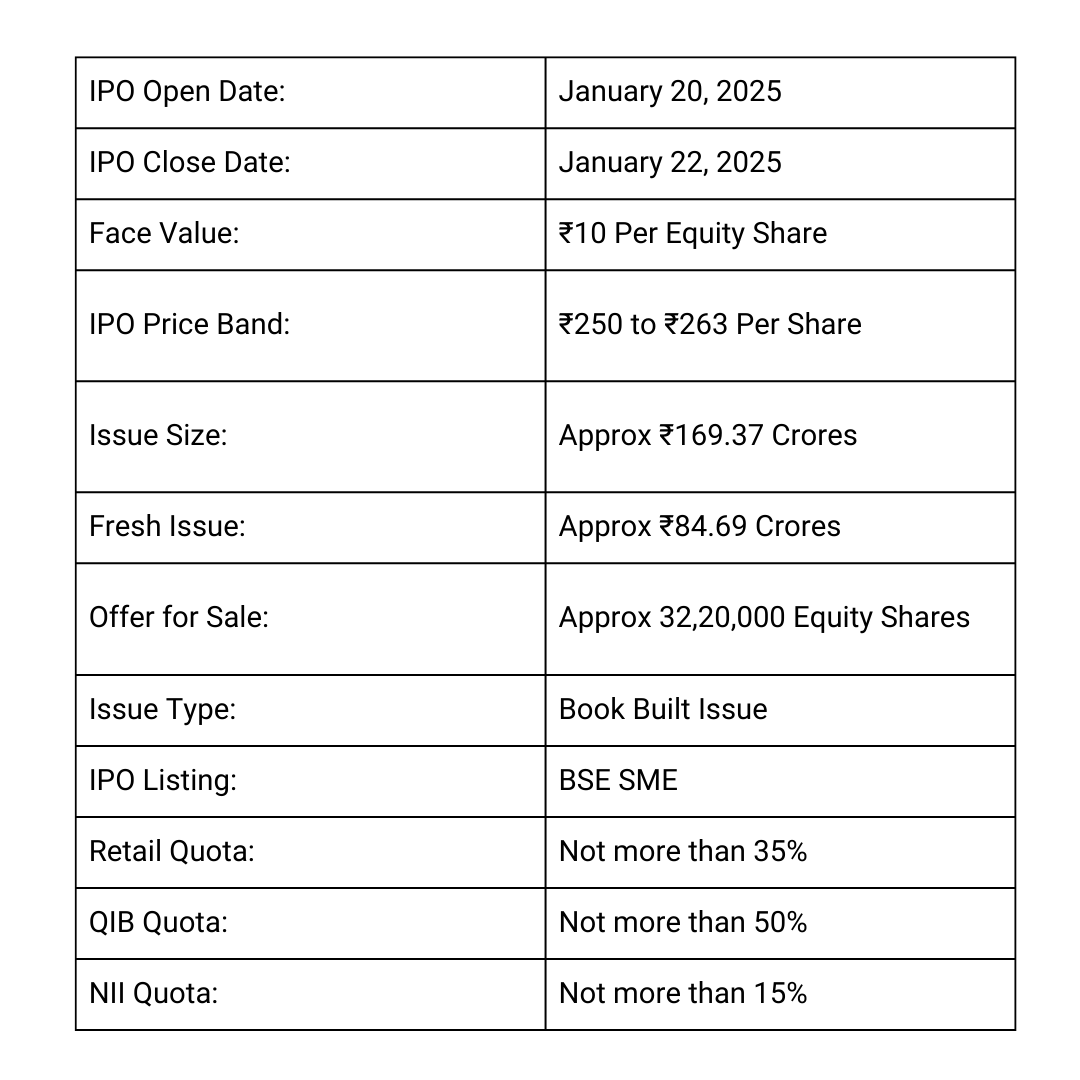

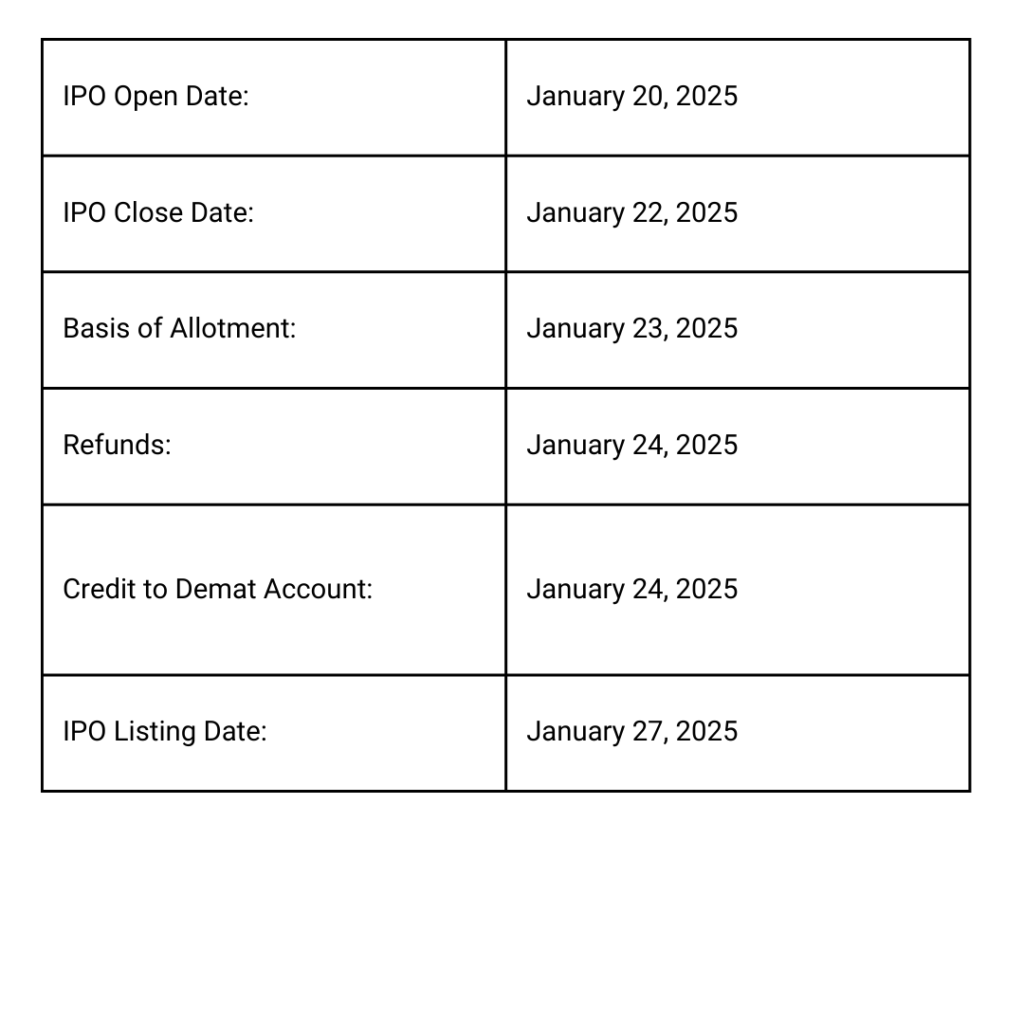

Capital Numbers Infotech Limited is set to launch its IPO from January 20, 2025, to January 22, 2025, as a Book Built Issue. The company aims to raise ₹169.37 crores, comprising a fresh issue of ₹84.69 crores and an offer for sale (OFS) of 32,20,000 equity shares with a face value of ₹10 each. The IPO price band is set at ₹250 to ₹263 per share, with retail investors allotted 35%, Qualified Institutional Buyers (QIBs) 50%, and Non-Institutional Investors (HNIs) 15%. The IPO allotment date is January 23, 2025, and the shares will be listed on the BSE on January 27, 2025. Financially, the company reported revenue growth from ₹92.98 crores in FY 2023 to ₹100.39 crores in FY 2024, marking a 7.97% increase, while profits rose significantly from ₹17.35 crores to ₹25.99 crores, reflecting a 49.78% growth. With strong financials and consistent growth, the IPO presents a promising long-term investment opportunity.

Capital Numbers Infotech IPO Date, Price Details

More About Capital Numbers Infotech

Capital Numbers Infotech is a leading digital consulting and IT engineering company that delivers top-notch software development solutions to enterprises and startups worldwide. The company offers a wide range of advanced technological services, including Digital Engineering, Data Analytics, Artificial Intelligence/Machine Learning (AI/ML), Cloud Engineering, UI/UX Design, Blockchain, and Augmented Reality/Virtual Reality (AR/VR). With a team of over 500 skilled IT professionals and consultants, Capital Numbers serves more than 250 clients across various locations in India and beyond. The team specializes in Cloud, Mobile, DevOps, and Data Engineering, as well as Application Development, leveraging cutting-edge technologies and frameworks like React, Angular, .NET, Python, Node, PHP, and Java to deliver innovative and high-quality solutions.

Capital Numbers Infotech IPO Dates

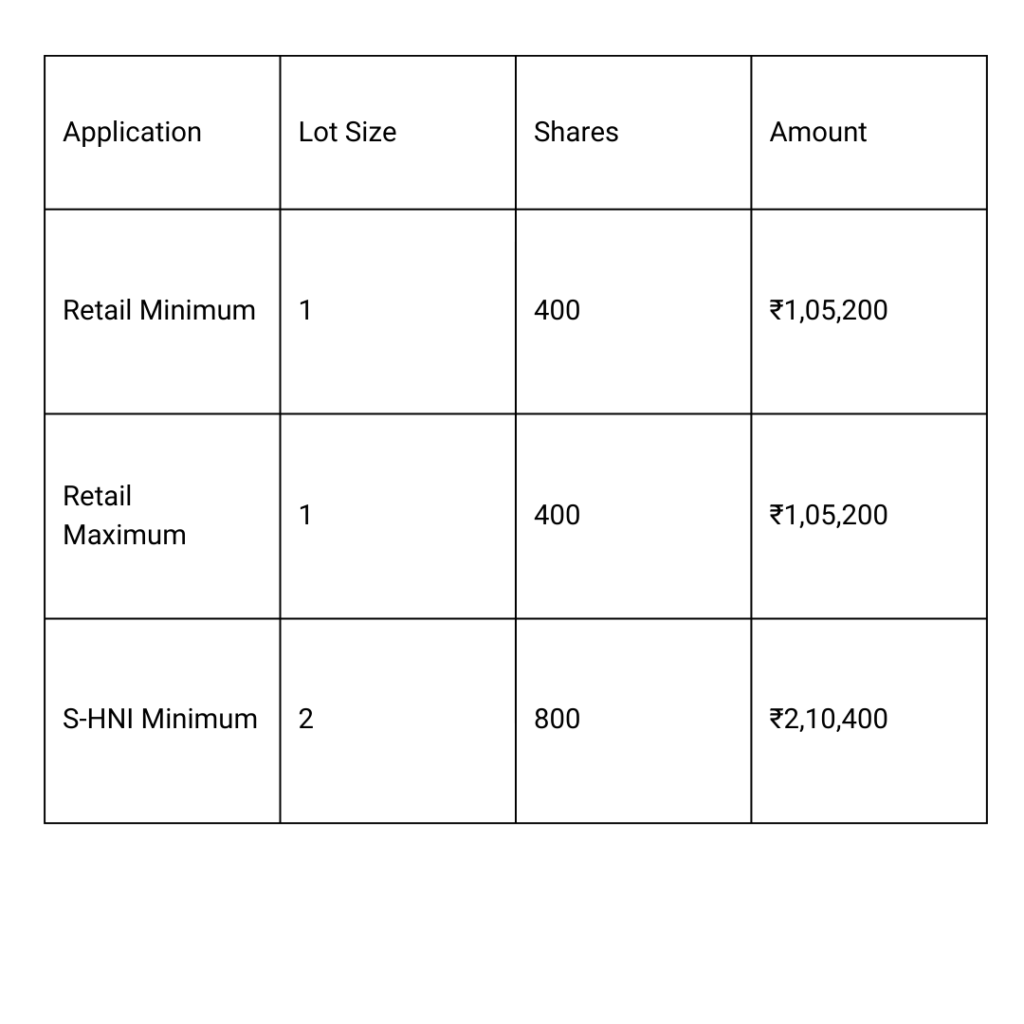

Capital Numbers Infotech IPO Market Lot

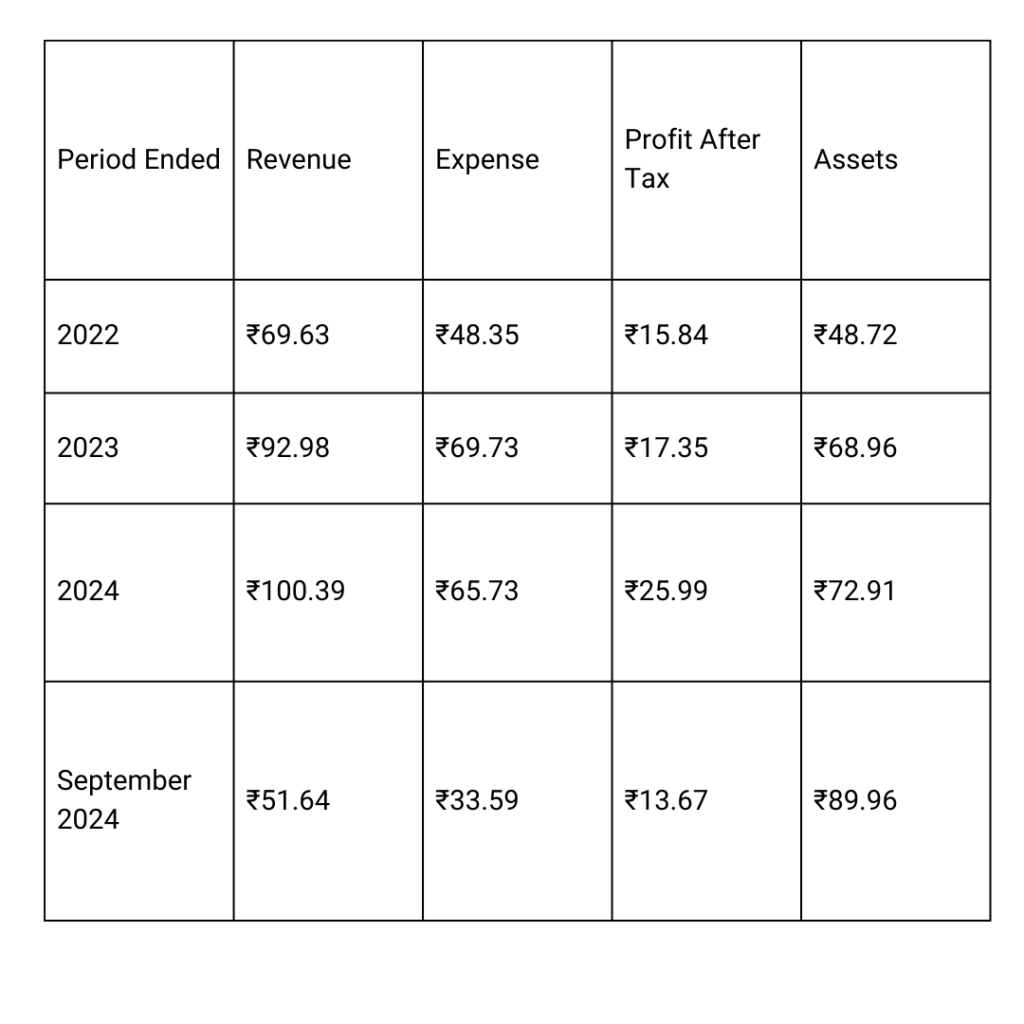

Capital Numbers Infotech Company All Financial Report

Amount ₹ in Crores

Capital Numbers Infotech Company All Financial Analysis

ROCE (Return on Capital Employed):

- 51.90%

- Indicates a high return generated on the capital employed, reflecting efficient utilization of resources.

RoNW (Return on Net Worth):

- 38.62%

- Reflects strong profitability compared to shareholders’ equity.

PAT Margin (Profit After Tax Margin):

- 26.47%

- Indicates a healthy profit level relative to revenue.

Price to Book Value (P/B Ratio):

- 8.29

- Suggests a high valuation compared to the book value, typical of growth companies or those with intangible assets.

Asset Growth:

- Assets increased consistently over the periods, from ₹4,872.20 Lakhs (Mar 2022) to ₹8,995.96 Lakhs (Sep 2024), showing strong expansion.

Revenue Trends:

- Revenue for the half-year ended Sep 2024 is ₹5,164.14 Lakhs, indicating robust performance relative to previous annual revenues.

Profitability:

- PAT increased significantly from ₹1,583.82 Lakhs in Mar 2022 to ₹2,598.88 Lakhs in Mar 2024. The PAT for Sep 2024 (₹1,367.04 Lakhs) suggests sustained profitability.

Net Worth & Reserves:

- Net Worth and Reserves have grown consistently, reflecting strong financial stability and reinvestment of profits.

Debt Levels:

- Total borrowing decreased and is not reported for Sep 2024 or Mar 2024, indicating possible debt repayment or self-sufficient operations.

Conclusion:

The company demonstrates strong financial health with impressive profitability metrics, consistent asset growth, and increasing net worth. The low borrowing levels and high return ratios (ROCE and RoNW) reinforce the company’s efficient operations and strong market positioning.