Sudeep Pharma IPO

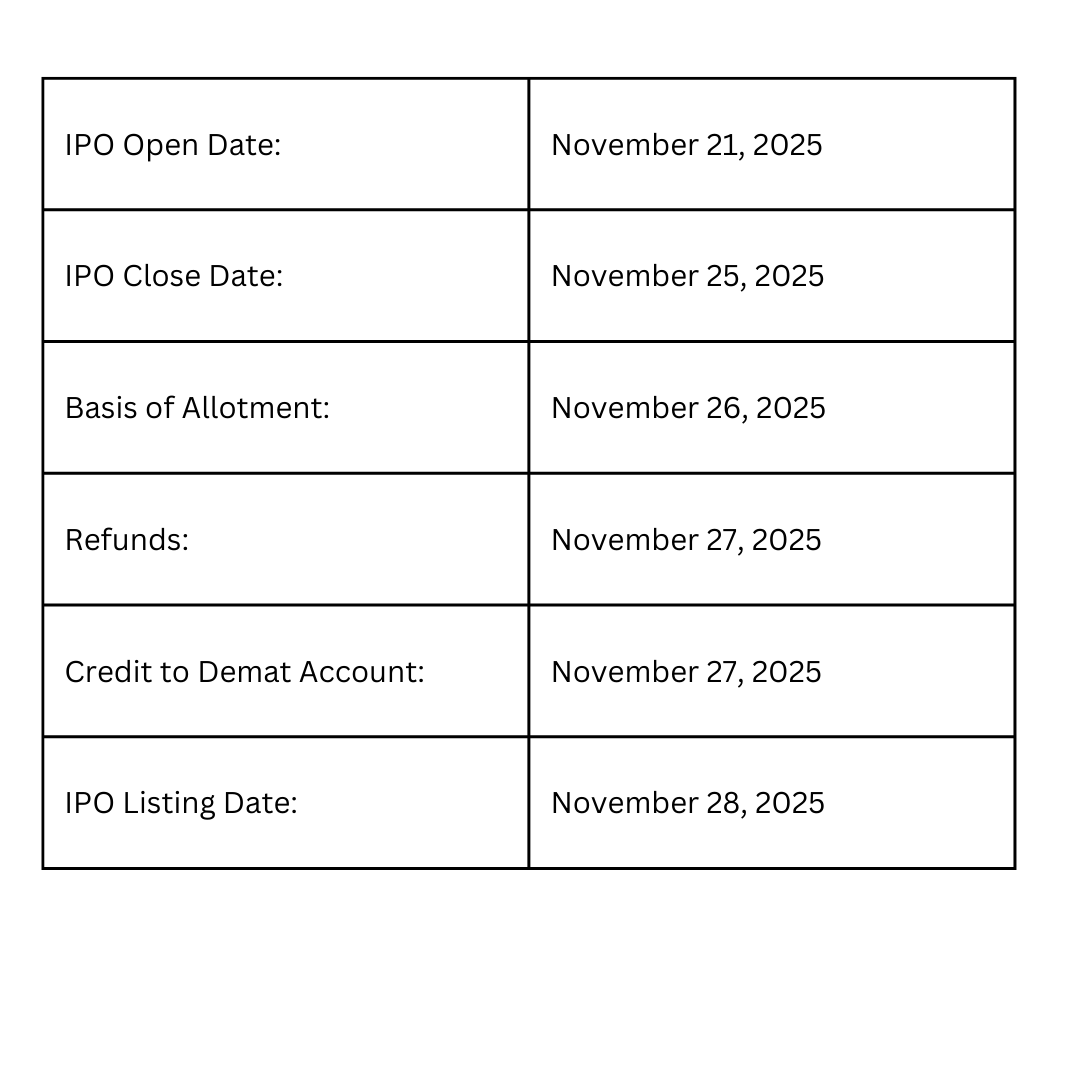

The Sudeep Pharma IPO will open on November 21, 2025, and close on November 25, 2025. It is a book-built issue, through which the company plans to raise ₹895 crore. This includes a fresh issue of ₹95 crore and an offer for sale (OFS) of up to 1,34,90,726 equity shares with a face value of ₹1 each.

The IPO price band has been set at ₹563–₹593 per share. The allocation structure is 50% for QIBs, 15% for HNIs, and 35% for retail investors. The shares are scheduled to be listed on the BSE and NSE on November 28, 2025, with the allotment date on November 26, 2025.

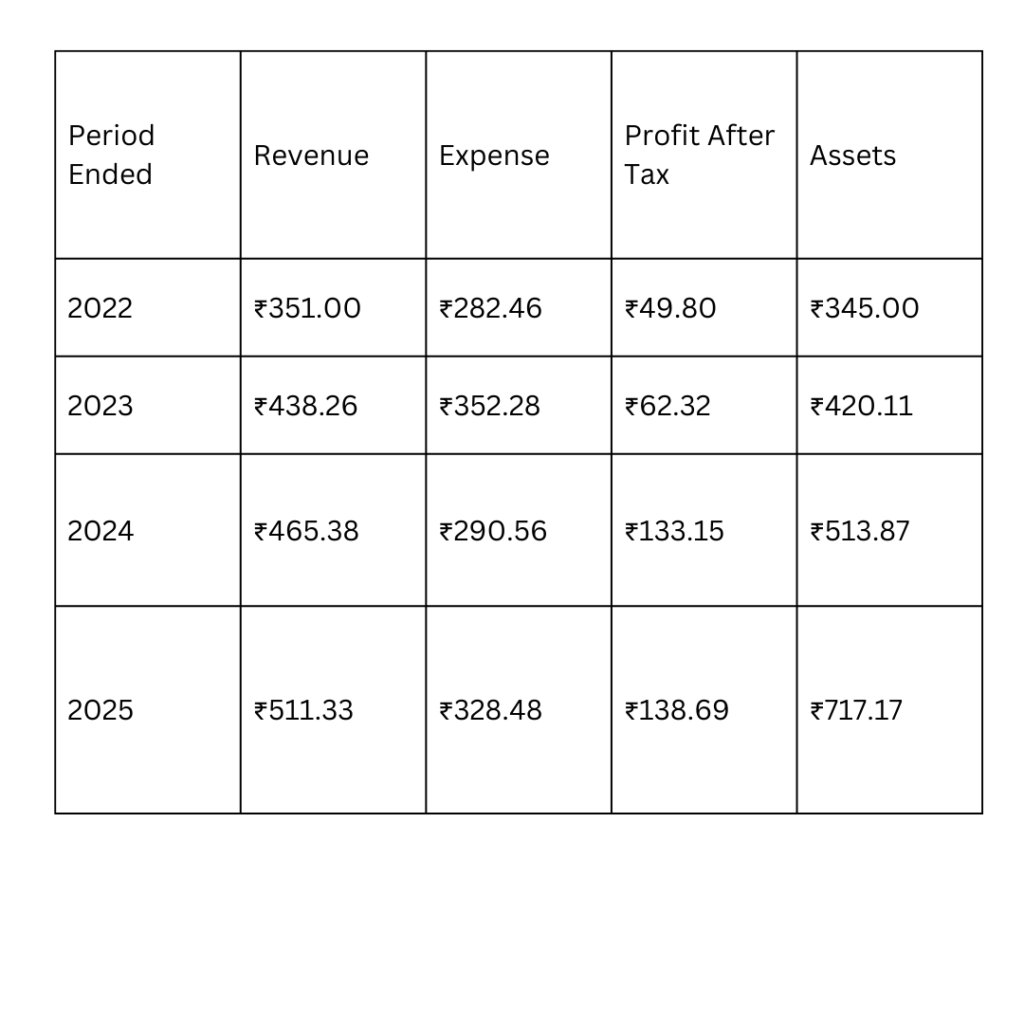

Financially, the company reported revenue of ₹511.33 crore in FY 2025, compared to ₹465.38 crore in FY 2024. Profit also increased from ₹133.15 crore in FY 2024 to ₹138.69 crore in FY 2025. Based on these financial trends, the IPO appears suitable for long-term investment.

Sudeep Pharma IPO Details

More About Sudeep Pharma IPO

Sudeep Pharma Limited, established in 1989, is a leading manufacturer of excipients and specialty ingredients used across the pharmaceutical, food, and nutrition sectors. The company contributes to the global healthcare ecosystem by supplying over 200 products to more than 100 countries. To drive innovation, Sudeep Pharma utilizes its own in-house technologies, including encapsulation, spray drying, granulation, trituration, liposomal preparations, and advanced blending.

The company’s operations are organized into two primary business verticals:

Pharmaceutical, Food, and Nutrition – offering essential mineral salts such as calcium, zinc, iron, potassium, magnesium, sodium, and copper.

Specialty Ingredients – covering micronutrient premixes, encapsulated ingredients, granulated minerals, and triturated blends.

Sudeep Pharma also operates six manufacturing facilities with a combined production capacity of 50,000 MT.

Sudeep Pharma IPO Company All Financial Report

Amount ₹ in Crores

Sudeep Pharma IPO Company All Financial Analysis

Key Performance Indicators (KPIs)

Return on Equity (ROE): 28.13%

Return on Capital Employed (ROCE): 29.82%

EBITDA Margin: 39.70%

PAT Margin: 27.63%

Debt-to-Equity Ratio: 0.20

Earnings Per Share (EPS) – Basic: ₹12.78

Price-to-Earnings (P/E) Ratio: Not Applicable

Return on Net Worth (RoNW): 27.88%

Net Asset Value (NAV): ₹45.86