H.M. Electro Mech IPO

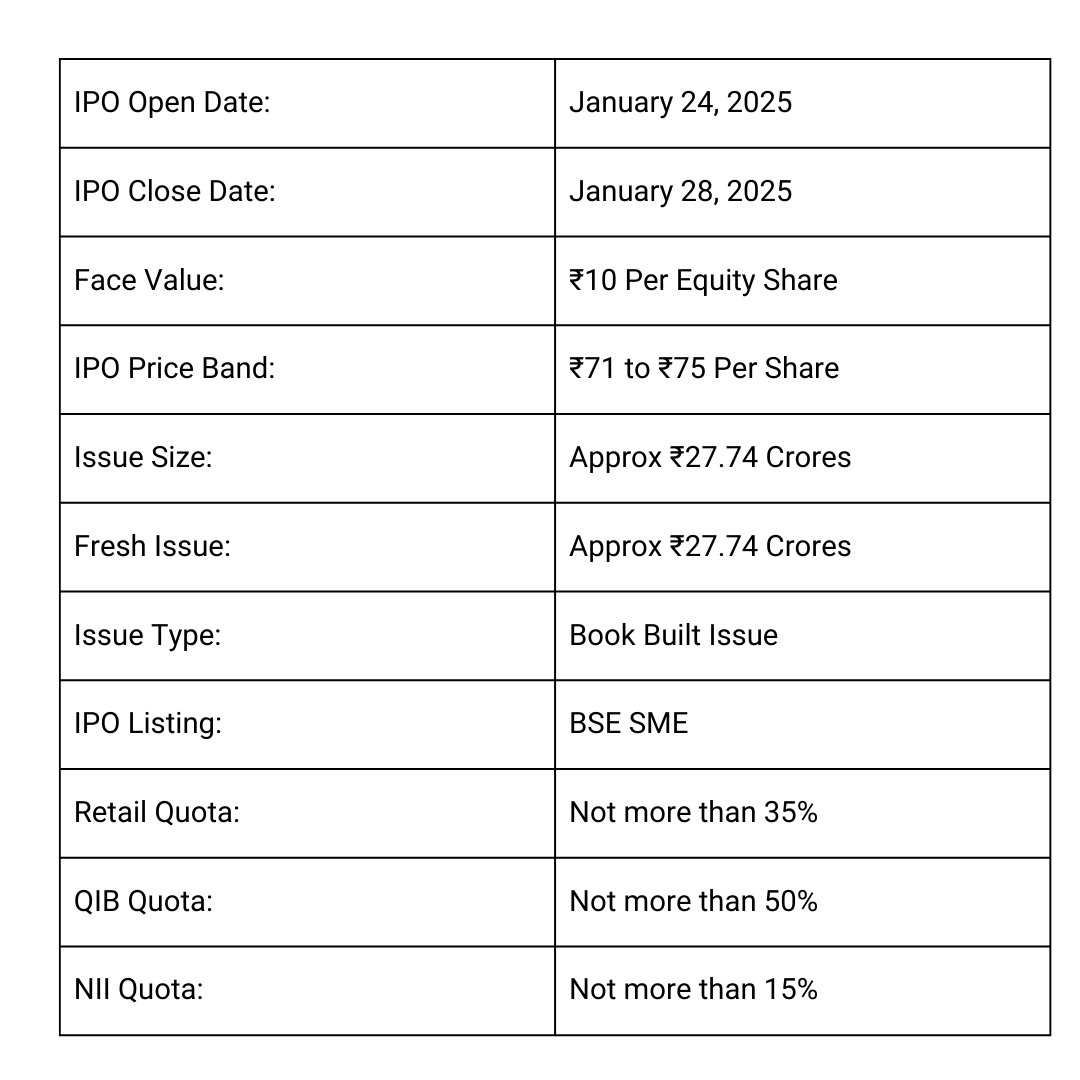

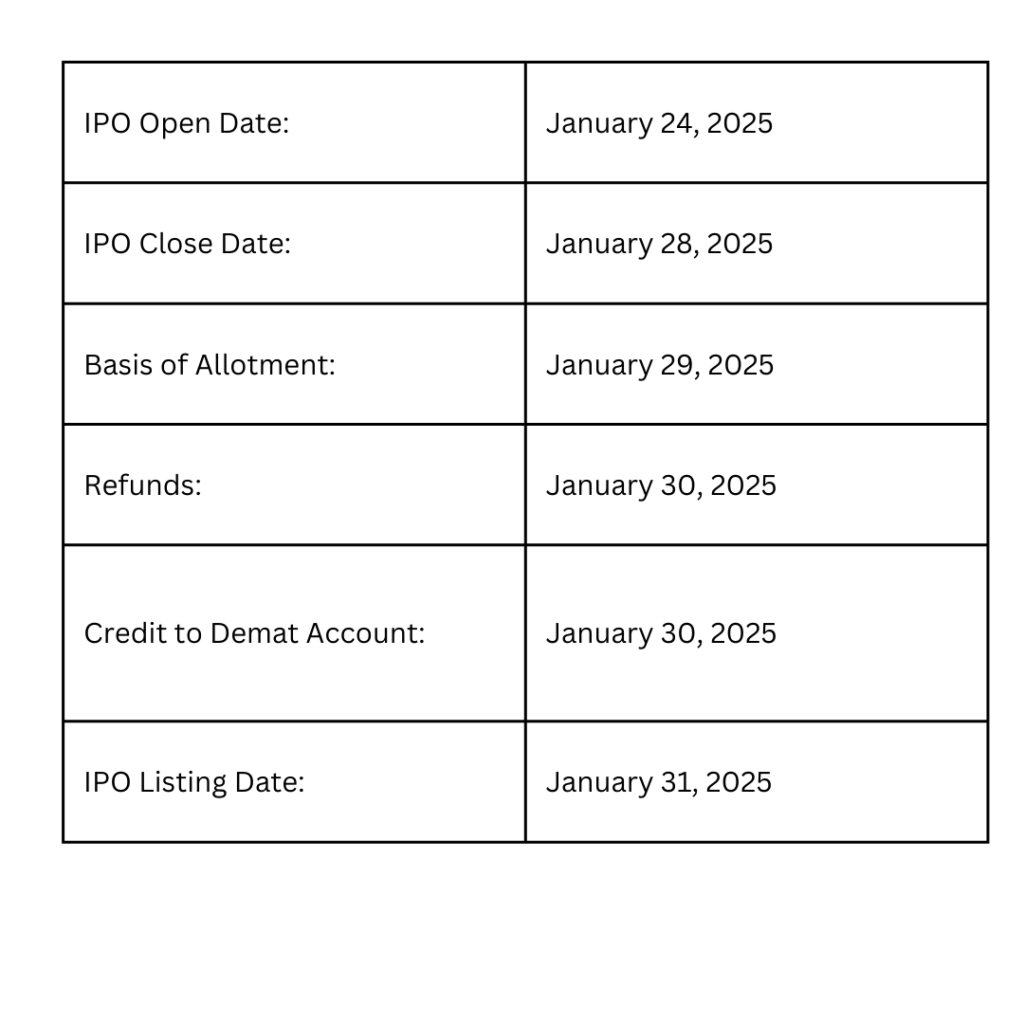

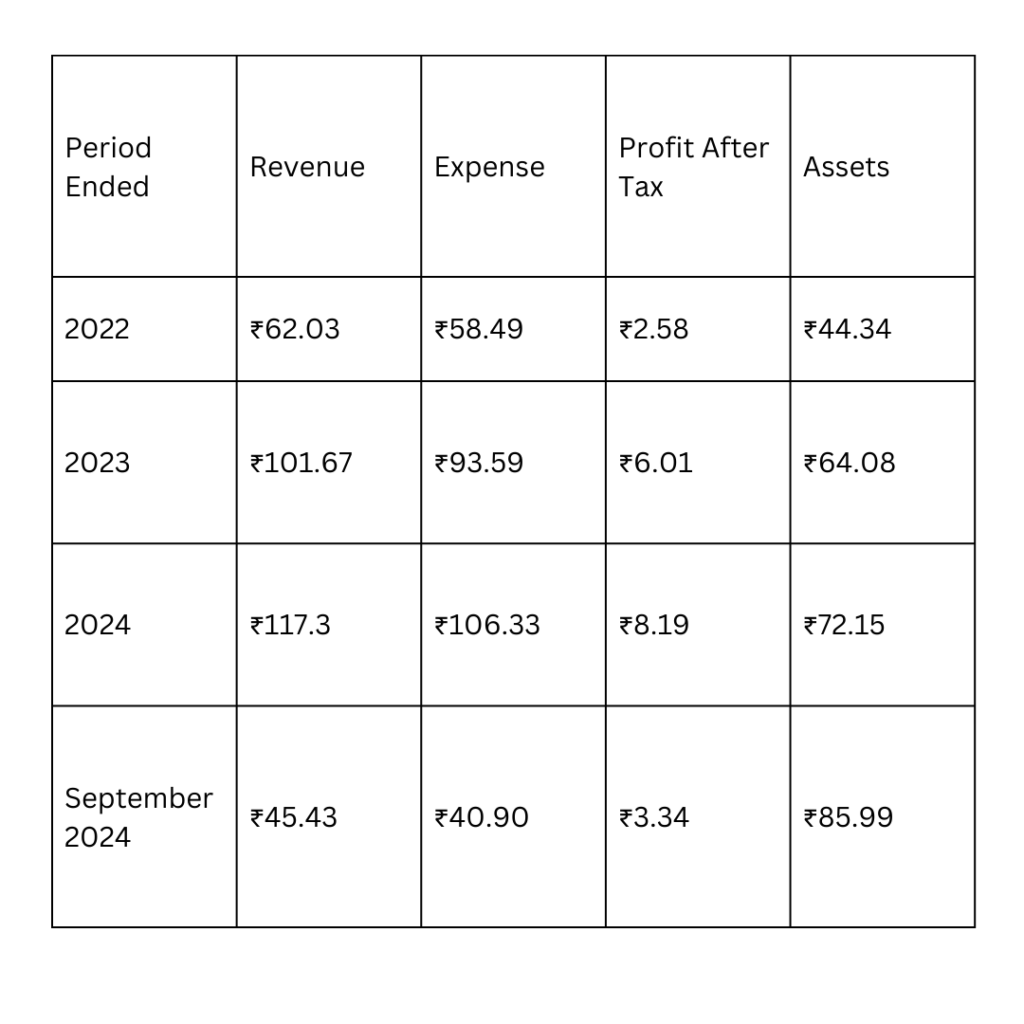

H.M. Electro Mech and Infra Solutions is launching its IPO on January 24, 2025, with the subscription period closing on January 28, 2025. The IPO, structured as a Book Built Issue, aims to raise approximately ₹27.74 crores, comprising a fresh issue of ₹27.74 crores and an offer for sale of equity shares with a face value of ₹10 each. The price band is set between ₹71 and ₹75 per share, with allocation quotas of 35% for retail investors, 50% for Qualified Institutional Buyers (QIB), and 15% for High Net-worth Individuals (HNI). The IPO allotment date is January 29, 2025, and the shares are scheduled to list on the BSE on January 31, 2025. Financially, the company reported revenue growth from ₹101.67 crores in FY 2023 to ₹117.3 crores in FY 2024, alongside a profit increase from ₹6.01 crores to ₹8.19 crores during the same period. With its consistent financial performance and profitability, the IPO offers a promising long-term investment opportunity for investors.

H.M. Electro Mech and Infra Solutions IPO Date , Price Details

More About H.M. Electro Mech IPO

H.M. Electro Mech Limited is a dynamic and growing company specializing in turnkey projects that encompass the supply, installation, testing, and commissioning of pumping machinery. Established in 2003, the company initially focused on infrastructure projects related to water supply and wastewater management. Over the years, it has diversified its expertise to include electrification projects and collaborations with prominent clients such as Indian Railways, nationalized banks, and municipal corporations.

Expanding its portfolio, H.M. Electro Mech has entered the EPC (Engineering, Procurement, and Construction) domain, where it undertakes large-scale projects involving cross-country pipelines and civil works tied to water supply systems. The company also engages in product sales, offering a variety of equipment such as pumps, pipes, transformers, motors, and other electronic accessories.

H.M. Electro Mech’s reputation for reliability and excellence stems from its strong management practices and a proven track record of on-time project delivery. Its clientele includes state and central government agencies, municipal corporations, banking institutions, and educational organizations. This diverse client base underscores the company’s credibility and trustworthiness in the industry.

With a workforce comprising 26 permanent employees and 28 contractual staff, H.M. Electro Mech continues to deliver quality solutions across its areas of expertise, cementing its position as a trusted name in the sector.

H.M. Electro Mech IPO Dates

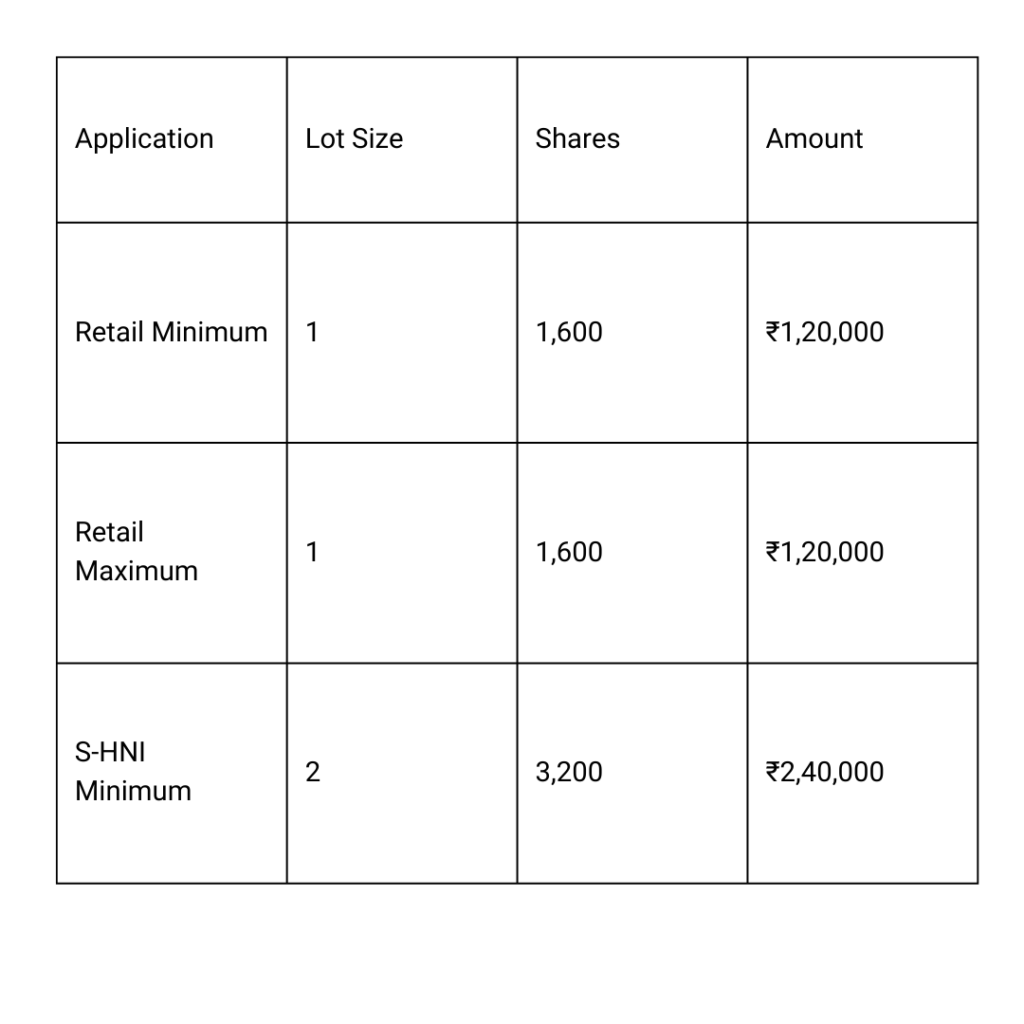

H.M. Electro Mech IPO Market Lot

H.M. Electro Mech IPO Company All Financial Report

H.M. Electro Mech IPO Company All Financial Analysis

Return on Equity (ROE): 29.06%

- Indicates how effectively the company generates profit from shareholders’ equity. A high ROE suggests efficient use of equity capital.

Return on Capital Employed (ROCE): 33.28%

- Measures the company’s profitability and efficiency in using its total capital. A higher ROCE indicates better performance.

EBITDA Margin: 10.73%

- Reflects the company’s operating profitability as a percentage of revenue. A decent margin shows the company can manage its operational costs effectively.

Profit After Tax (PAT) Margin: 6.99%

- Indicates the percentage of revenue left as net profit after all expenses, including taxes. A positive margin reflects good profitability.

Debt-to-Equity Ratio: 0.38

- Shows the proportion of debt financing relative to shareholders’ equity. A lower ratio (below 1) suggests moderate leverage and financial stability.

Earnings Per Share (EPS): ₹8.19 (Basic)

- Represents the portion of a company’s profit allocated to each outstanding share of common stock. It’s a key measure for investors to evaluate profitability.

Price/Earnings (P/E) Ratio: N/A

- The P/E ratio is not available here, potentially due to negative earnings or lack of a market price.

Return on Net Worth (RoNW): 25.37%

- Similar to ROE but focuses specifically on the shareholders’ funds. Indicates the company’s efficiency in generating returns from net worth.

Net Asset Value (NAV): ₹32.27

- Reflects the value of a company’s assets minus liabilities per share. It’s often used for asset-heavy industries or funds.