Arisinfra Solutions IPO

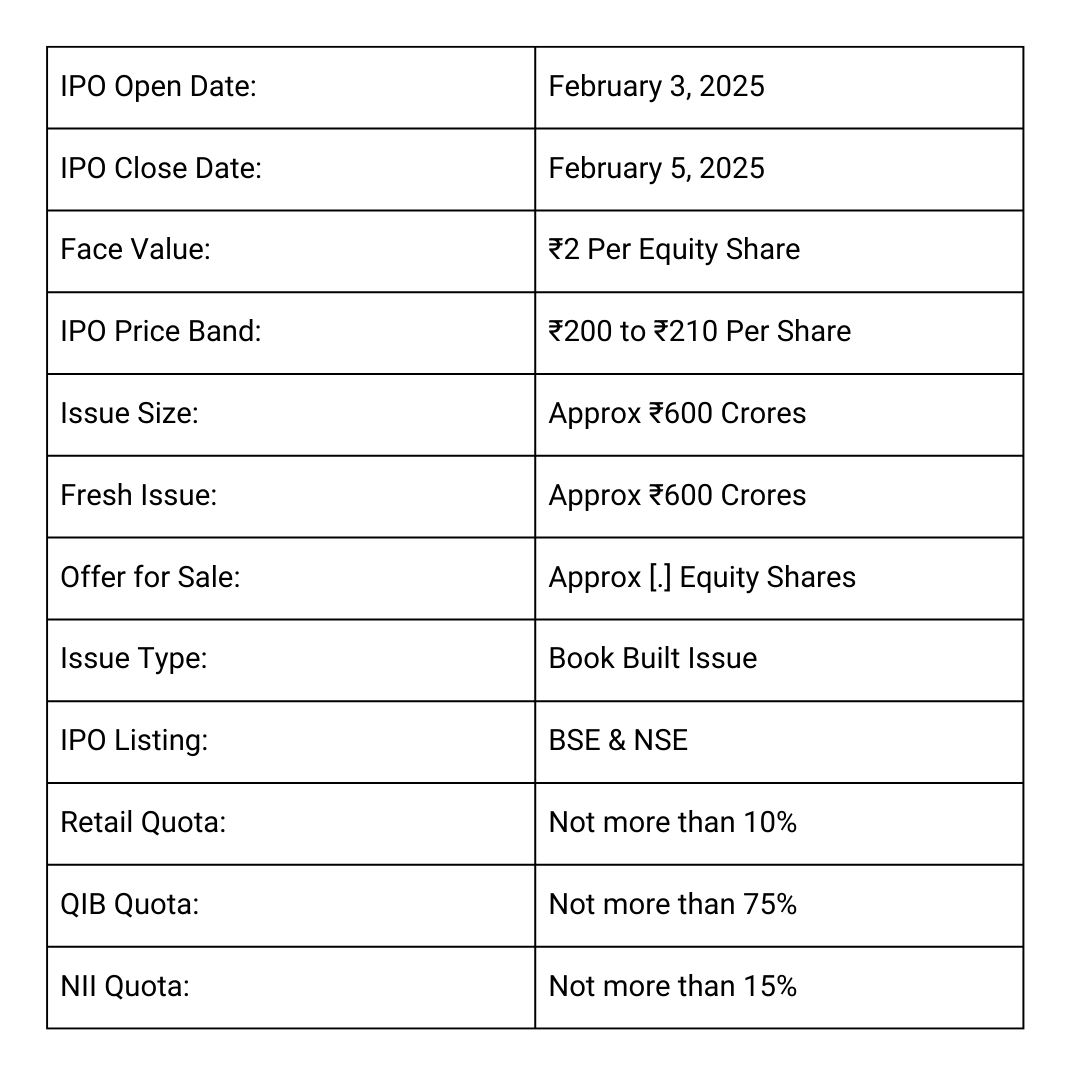

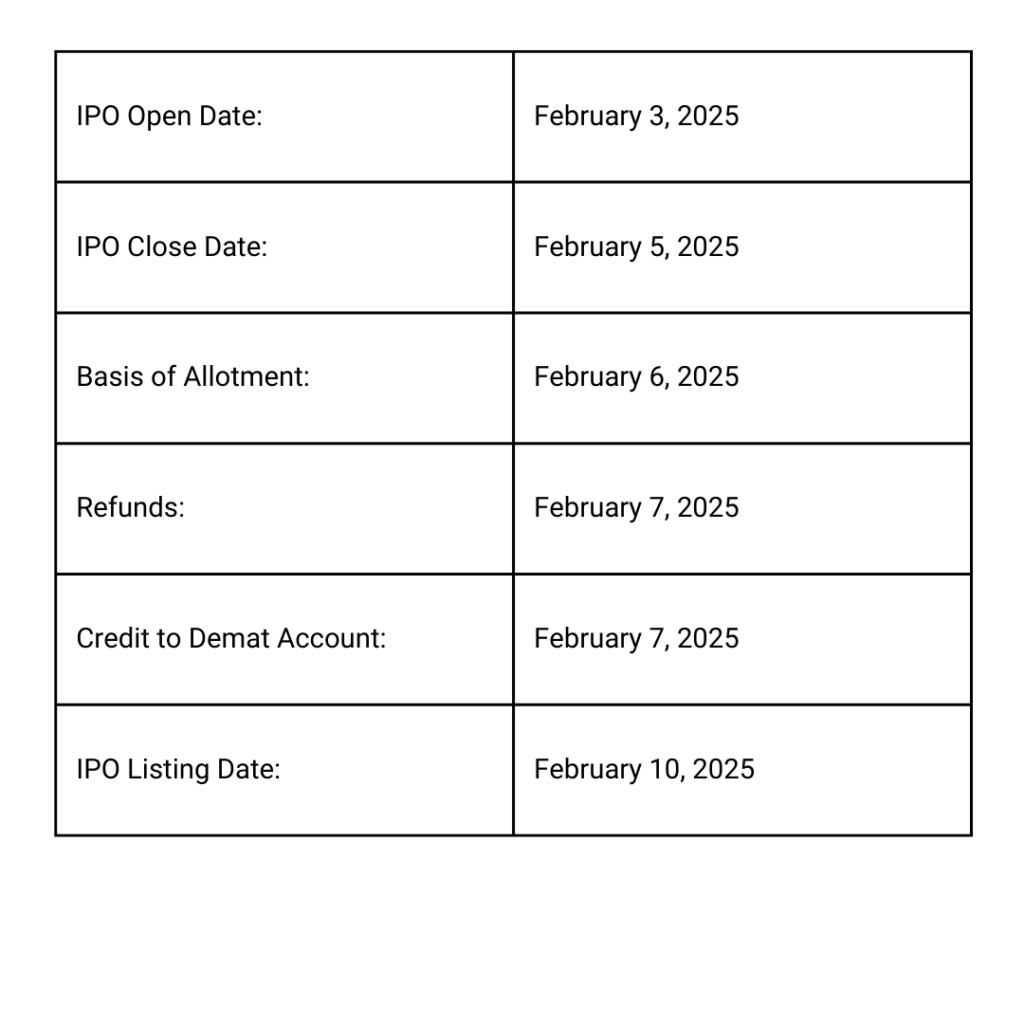

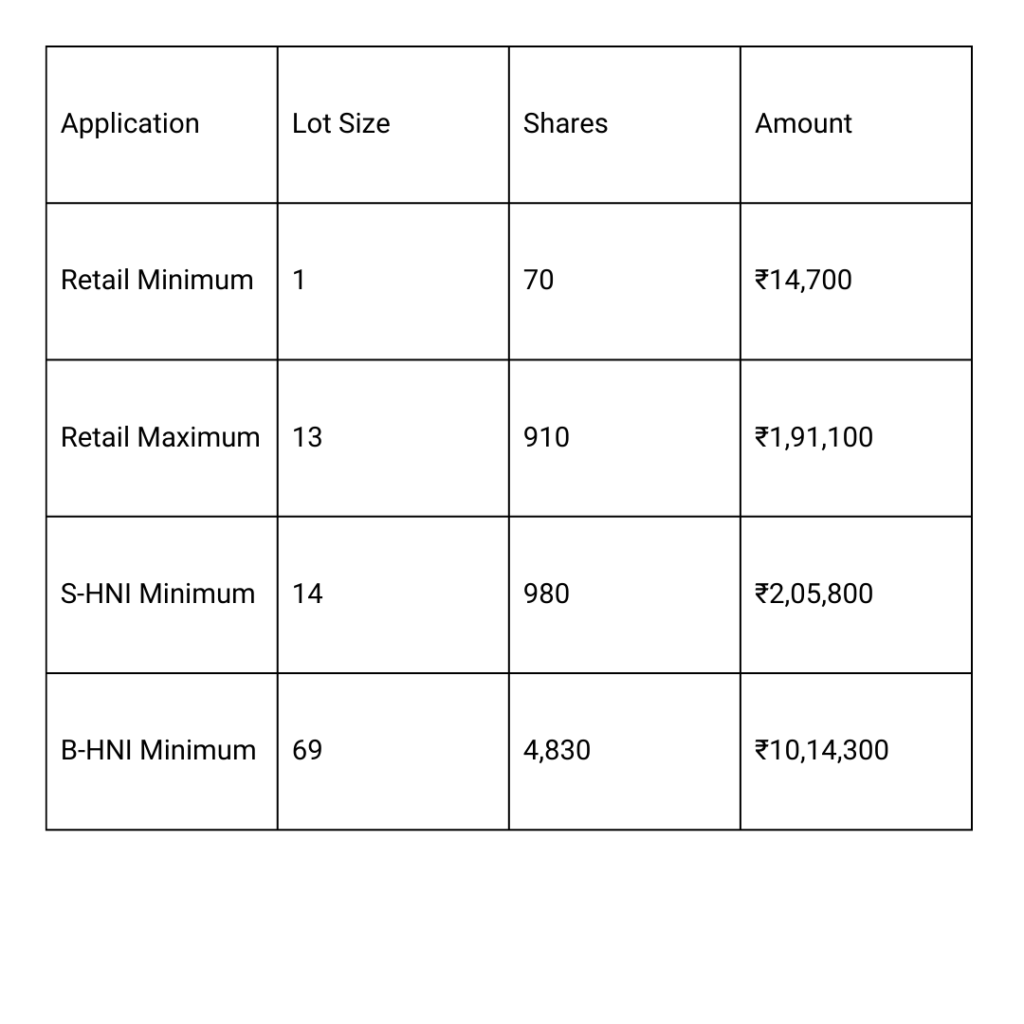

The Arisinfra Solutions IPO is set to open on February 3, 2025, and close on February 5, 2025, as a Book Built Issue aiming to raise ₹600 crores, comprising a fresh issue of ₹600 crores and an offer for sale of equity shares with a face value of ₹2 each. The IPO price band is set between ₹200 and ₹210 per share, with allocations of 10% for retail investors, 75% for Qualified Institutional Buyers (QIBs), and 15% for High Net-Worth Individuals (HNIs). The allotment date is February 6, 2025, and the shares will list on the BSE and NSE on February 10, 2025. Financially, the company reported a revenue of ₹702.36 crores in FY 2024, down from ₹754.44 crores in FY 2023, with a net loss widening to ₹17.30 crores from ₹15.40 crores during the same period. While the company has posted consecutive losses, long-term investors may find potential value in the IPO based on growth prospects in its sector. Investors should consider their risk appetite before applying.

Arisinfra Solutions IPO Date, Price Details

More About Arisinfra Solutions IPO

Incorporated in 2021, ArisInfra Solutions Limited is a modern, technology-driven B2B platform revolutionizing the construction and infrastructure sector by streamlining the procurement of materials and offering smart financial management solutions. The company focuses on digitizing and simplifying the end-to-end procurement process to deliver a seamless customer experience. Its diverse product portfolio includes steel products such as GI pipes, MS wires, and MS TMT bars, as well as cement products like OPC bulk, among others. Between April 1, 2021, and March 31, 2024, ArisInfra facilitated the delivery of 10.35 million metric tonnes of construction materials—including aggregates, ready-mix concrete, steel, cement, construction chemicals, and walling solutions—through a network of 1,458 vendors. The company served 2,133 customers across 963 pin codes in cities such as Mumbai, Bengaluru, and Chennai.

Arisinfra Solutions IPO Dates

Arisinfra Solutions IPO Market Lot

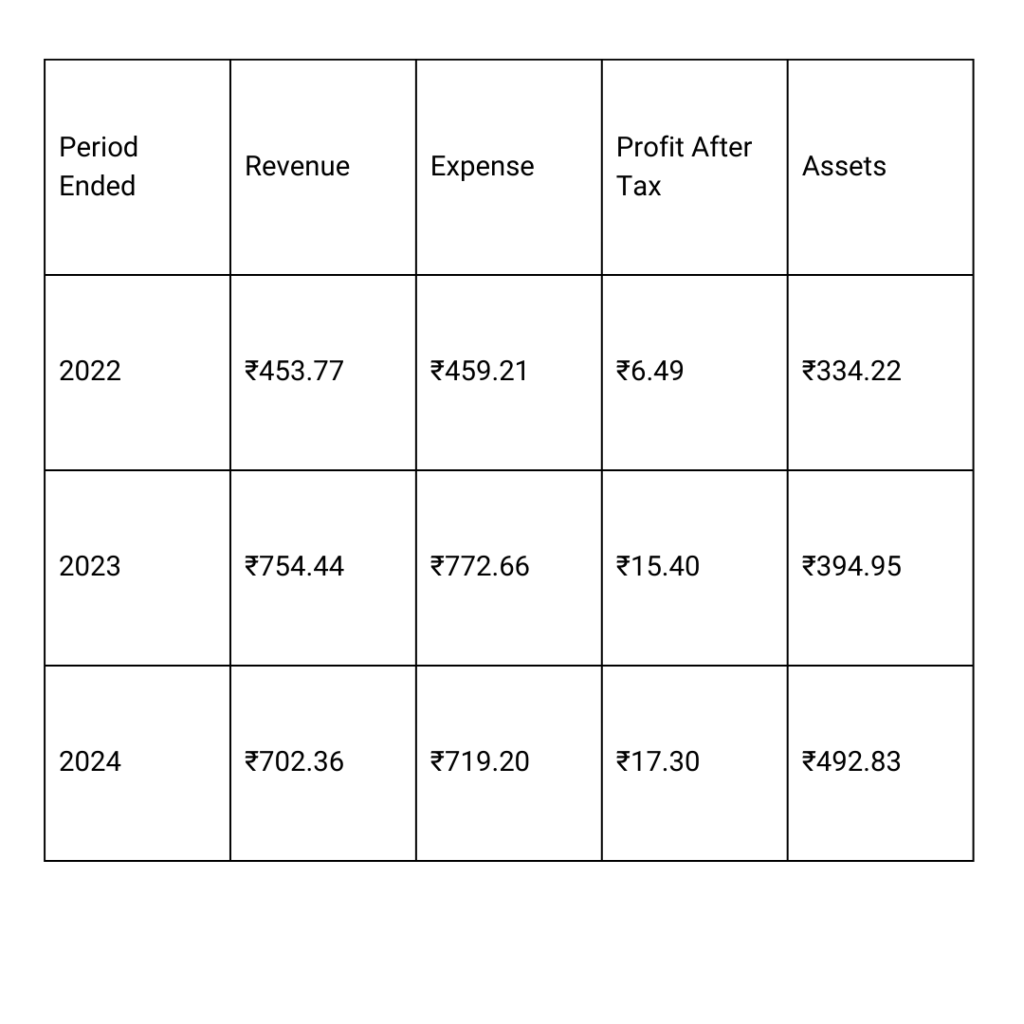

Arisinfra Solutions IPO Company All Financial Report

Amount ₹ in Crores

Arisinfra Solutions IPO Company All Financial Analysis

Debt/Equity Ratio (1.45):

- Indicates the company has 1.45 units of debt for every unit of equity, reflecting significant leverage. A high ratio could signal financial risk if profits don’t improve.

Assets:

- Total assets have consistently grown year-on-year, increasing by 24.76% from 2023 to 2024 and 18.17% from 2022 to 2023. This suggests business expansion or capital investments.

Revenue:

- Revenue declined by 6.91% in 2024 compared to 2023 but saw a significant increase of 66.24% from 2022 to 2023. The drop in 2024 could indicate challenges in sales or market conditions.

Profit After Tax (PAT):

- The company remains in a loss-making position, with losses widening over the three years:

- 2024: -17.3

- 2023: -15.39

- 2022: -6.49

- The trend reflects increasing operational challenges or rising expenses.

- The company remains in a loss-making position, with losses widening over the three years:

Net Worth:

- Net worth improved from 2023 to 2024 (up 34.91%) but was significantly lower than in 2022, indicating ongoing financial stress.

Reserves and Surplus:

- Improved drastically from -41.36 (2023) to 139.77 (2024), reflecting a positive turnaround in retained earnings or equity injections.

Total Borrowing:

- Borrowings have steadily increased, growing by 24.35% from 2023 to 2024 and 42.85% from 2022 to 2023, potentially to fund operations or growth amidst losses.

Return on Net Worth (RoNW):

- At -13.14%, it reflects a negative return on equity, which is a result of consistent losses.

Conclusion:

The company demonstrates growth in assets and reserves but is grappling with declining profitability and increasing borrowings. Prioritizing cost management, revenue growth, and debt reduction would be crucial to improving financial health.