Landmark Immigration IPO

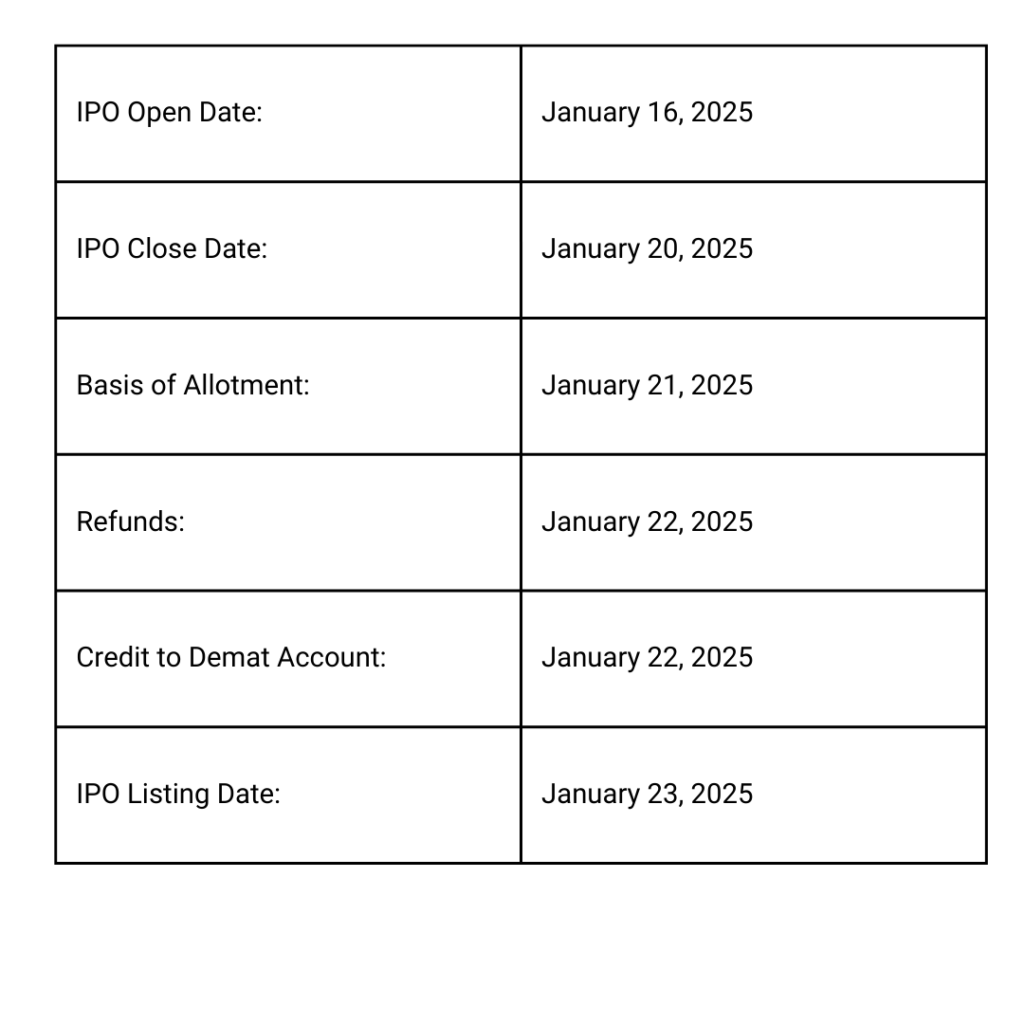

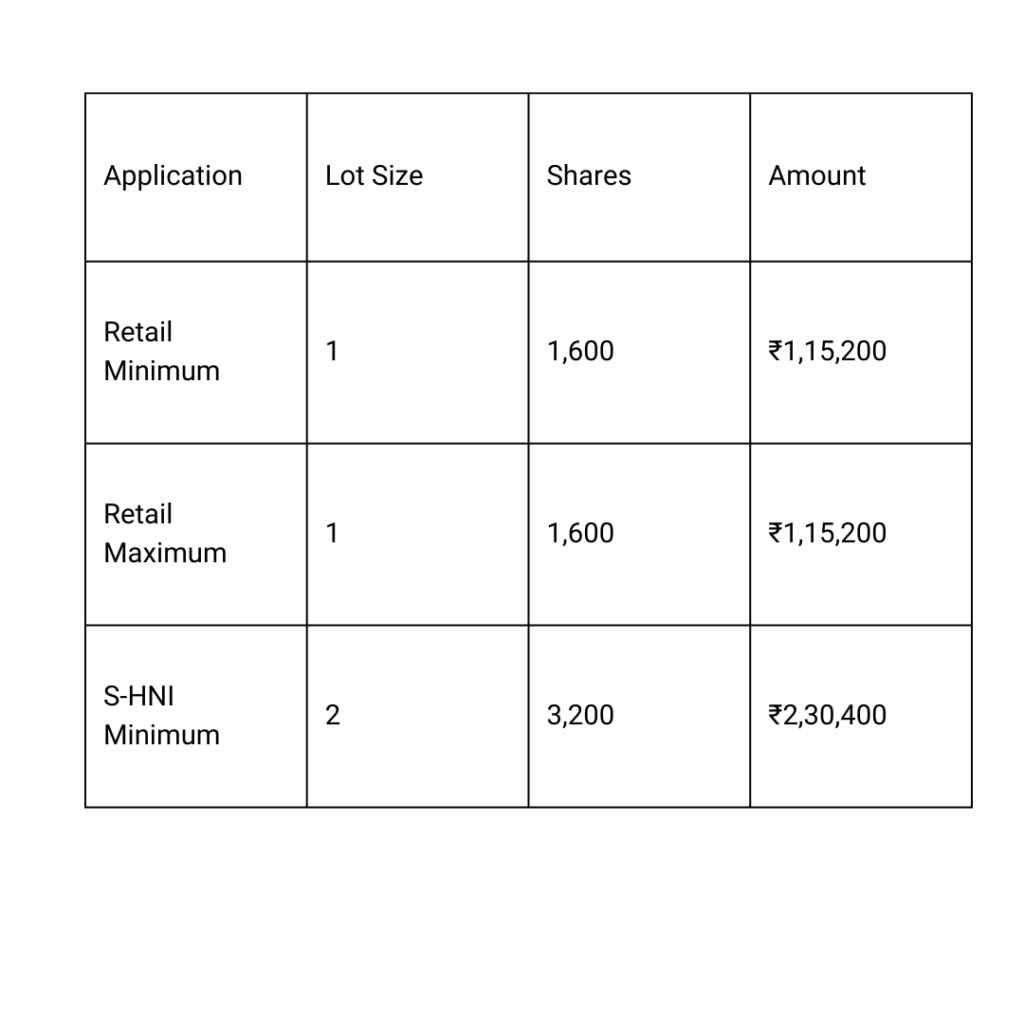

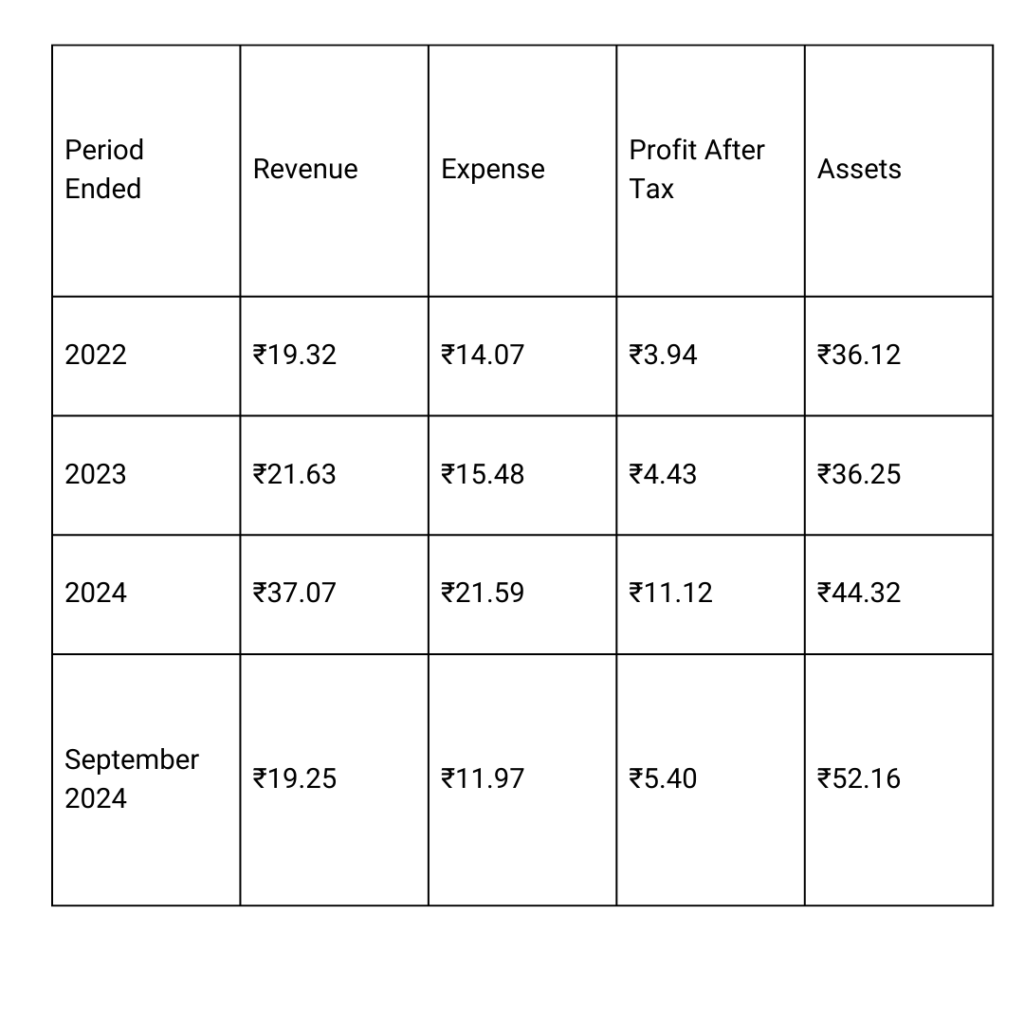

The Landmark Immigration IPO is set to open on January 16, 2025, and close on January 20, 2025, with the listing scheduled for January 23, 2025. The IPO is a book-built issue, aiming to raise ₹40.32 crores, comprising a fresh issue of ₹40.32 crores and an offer for sale, though the exact number of equity shares for the OFS has not been disclosed. Priced within a band of ₹70 to ₹72 per share with a face value of ₹10 each, the retail quota is allocated 35%, QIBs 50%, and HNIs 15%. The allotment date is January 21, 2025. Financially, the company has shown robust growth, with revenue increasing from ₹21.63 crores in FY 2023 to ₹37.07 crores in FY 2024 and profit rising from ₹4.43 crores to ₹11.12 crores in the same period, reflecting a growth rate of ~71.4% in revenue and ~151% in profit. Given this strong financial performance, the IPO is deemed promising for long-term investors seeking sustainable returns.

Landmark Immigration IPO Date, Review, Price, Allotment Details

More About Landmark Immigration IPO

Landmark Immigration, established in 2007, is a leading global consulting company specializing in Global Education Consultancy (GEC) and Immigration Consultancy (IC) services. The organization primarily serves students and clients from Punjab, Chandigarh, and Vadodara, offering advanced solutions tailored to their needs.

Key Services:

- Global Education Consultancy: Assistance with education consulting, scholarship and education loan guidance, admission application formalities, language proficiency test training, and study/schooling visas.

- Immigration Consultancy: Guidance for business, tourism, and permanent residency (PR) applications.

Financial Highlights:

- Revenue: ₹37.07 crores in 2024, up from ₹21.63 crores in 2023.

- Profit: ₹11.12 crores in 2024, a significant increase from ₹4.43 crores in 2023.

This consistent growth reflects Landmark Immigration’s commitment to delivering high-quality services to students and clients aspiring to pursue opportunities abroad, particularly in Canada.

Landmark Immigration IPO Dates

Landmark Immigration IPO Market Lot

Landmark Immigration IPO Company All Financial Report

Amount ₹ in Crores

Landmark Immigration IPO Company All Financial Analysis

Return on Equity (ROE): 35.64%

- Indicates strong profitability relative to shareholder equity. A ROE above 20% is generally considered excellent.

Return on Capital Employed (ROCE): 41.99%

- Shows efficient use of capital in generating profits. A ROCE above the cost of capital signals effective operations.

EBITDA Margin: 41.87%

- A high EBITDA margin suggests strong operational efficiency and robust profitability before depreciation, interest, and taxes.

PAT (Profit After Tax) Margin: 31.87%

- Reflects strong net profitability after all expenses, including taxes. A PAT margin above 20% is very healthy.

Debt-to-Equity Ratio: 0.02

- Extremely low leverage indicates financial stability and minimal reliance on debt.

Earnings Per Share (EPS): ₹7.41 (Basic)

- Demonstrates the company’s profitability on a per-share basis, useful for comparing with peers.

Price/Earnings (P/E) Ratio: N/A

- P/E ratio is unavailable, possibly due to the lack of current market price or earnings anomalies.

Return on Net Worth (RoNW): 30.25%

- A solid RoNW indicates the company’s ability to generate profit relative to shareholder funds.

Net Asset Value (NAV): ₹24.49

- Reflects the per-share value of the company’s assets minus liabilities, serving as a valuation benchmark.

Key Insights:

- The company exhibits strong profitability (high ROE, ROCE, PAT margin) and operational efficiency (high EBITDA margin).

- Its low debt-to-equity ratio underscores minimal financial risk.

- The absence of a P/E ratio suggests caution or the need for further analysis regarding its market valuation.

- EPS and NAV highlight solid fundamentals.