Rikhav Securities IPO

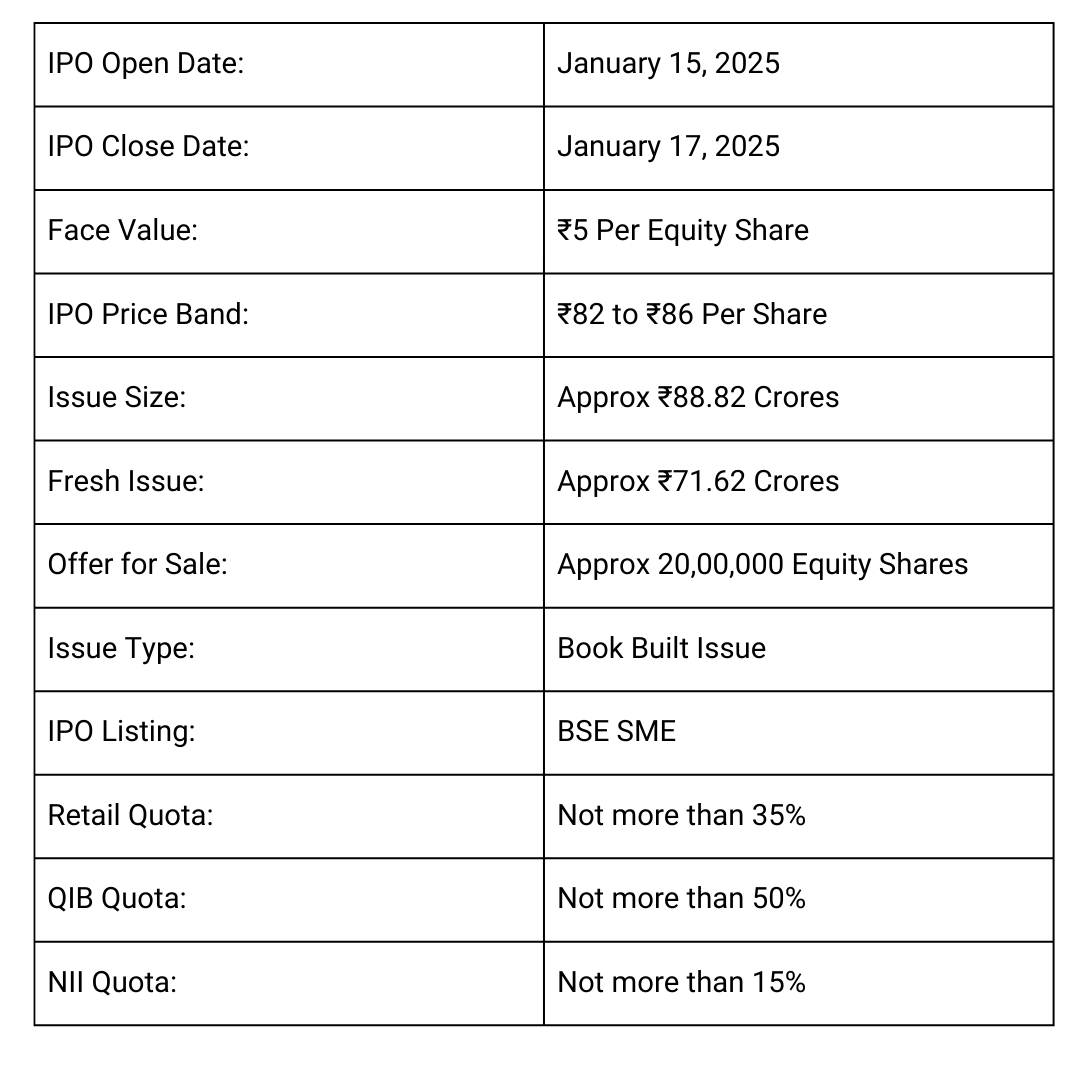

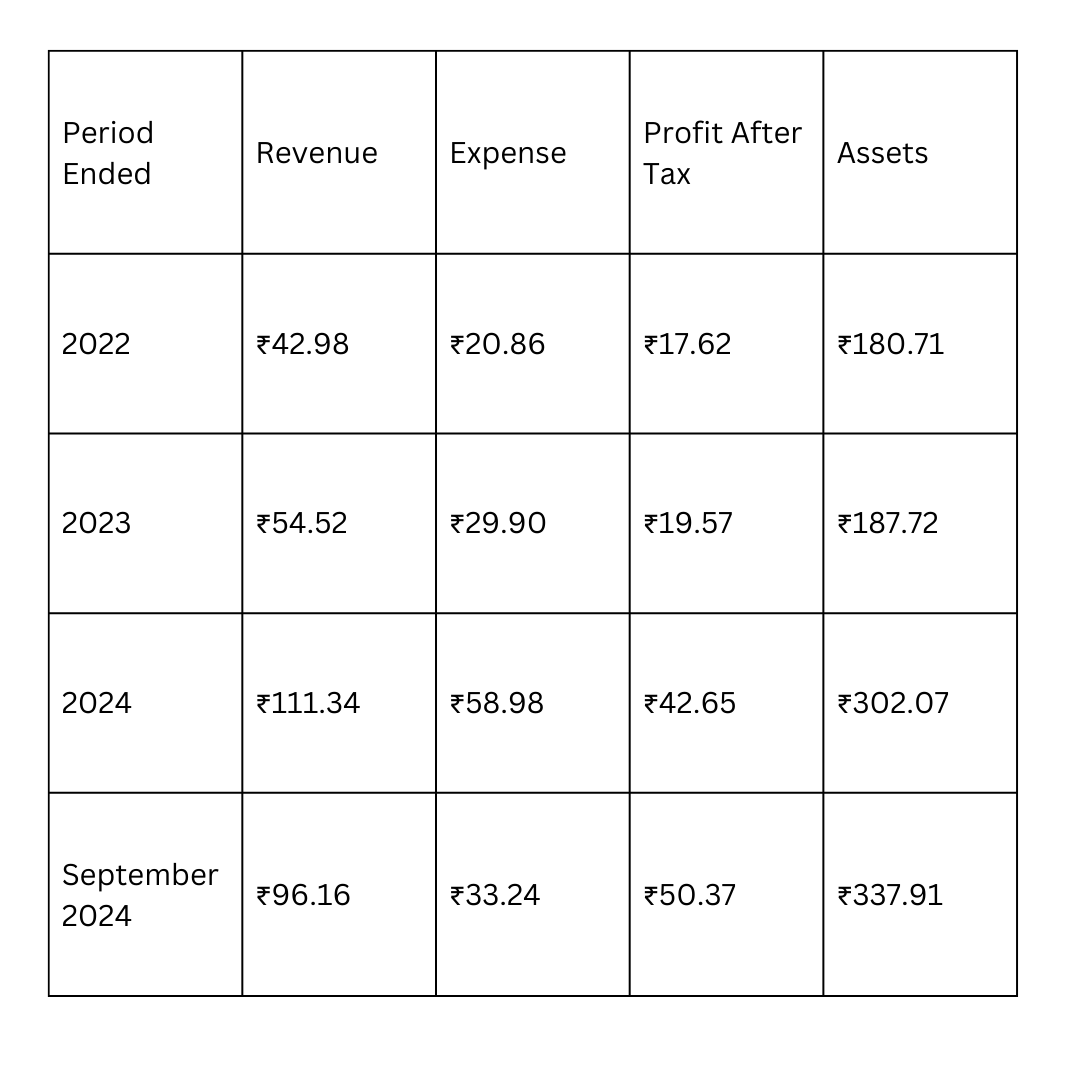

The Rikhav Securities IPO is set to open on January 15, 2025, and close on January 17, 2025, as a Book Built Issue aiming to raise ₹88.82 crores. This includes a fresh issue of ₹71.62 crores and an offer for sale of up to 20,00,000 equity shares with a face value of ₹5 each. The IPO price band is between ₹82 and ₹86 per share, with allocations divided into 50% for Qualified Institutional Buyers (QIB), 15% for High Net-Worth Individuals (HNI), and 35% for retail investors. The company has reported remarkable financial growth, with revenue rising from ₹54.52 crores in FY 2023 to ₹111.34 crores in FY 2024, a 104.2% increase, and profit growing from ₹19.10 crores to ₹42.65 crores, a 123.3% rise during the same period. With a listing date on the BSE scheduled for January 22, 2025, and allotment on January 20, 2025, the IPO appears promising for long-term investors due to the company’s robust performance and growth potential. Investors are advised to assess their risk appetite and seek professional advice before applying.

Rikhav Securities IPO Date, Review, Price, Allotment Details

More About Rikhav Securities IPO

Founded in 1995, Rikhav Securities is a prominent financial services company offering a diverse range of services, including equity broking, investing, and trading. The firm is registered with the Securities and Exchange Board of India (SEBI) as a stockbroker and holds memberships with the BSE (Bombay Stock Exchange), NSE (National Stock Exchange), and MCX (Multi Commodity Exchange).

Core Services:

- Equity Broking: Cash delivery and intraday trading.

- Derivatives Trading: Futures and options.

- Commodities Trading: Services tailored for both regular and high-net-worth clients.

- Market-Making: Facilitated the listing of 66 companies on SME platforms.

Technology & Reach:

Rikhav Securities offers its services through online and digital platforms, making trading and investing more accessible to its clients.

Financial Highlights:

- Revenue (2024): ₹104.16 crores, marking a consistent increase over the last two years.

- Personnel: Approximately 394 employees on its payroll.

With decades of experience and a strong presence in financial markets, Rikhav Securities continues to be a trusted partner for individuals and businesses seeking tailored investment solutions.

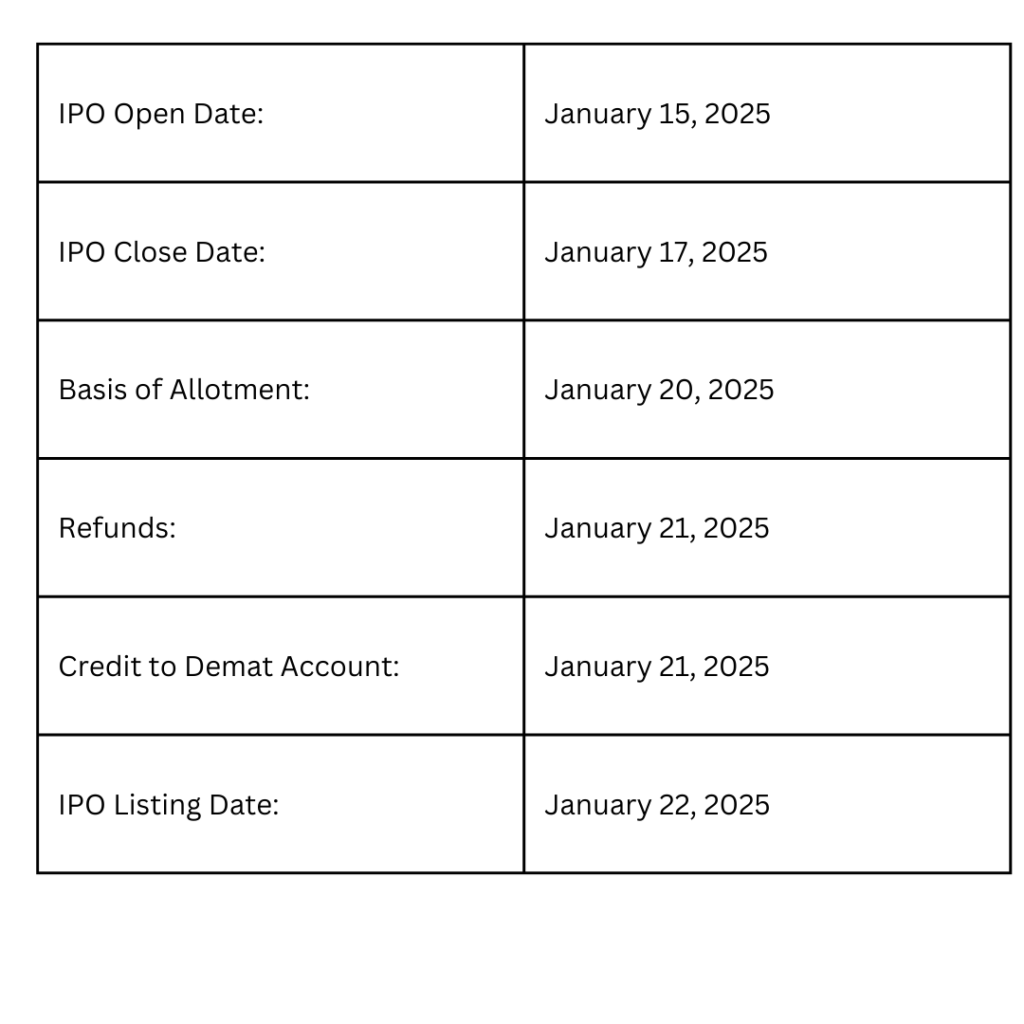

Rikhav Securities IPO Date

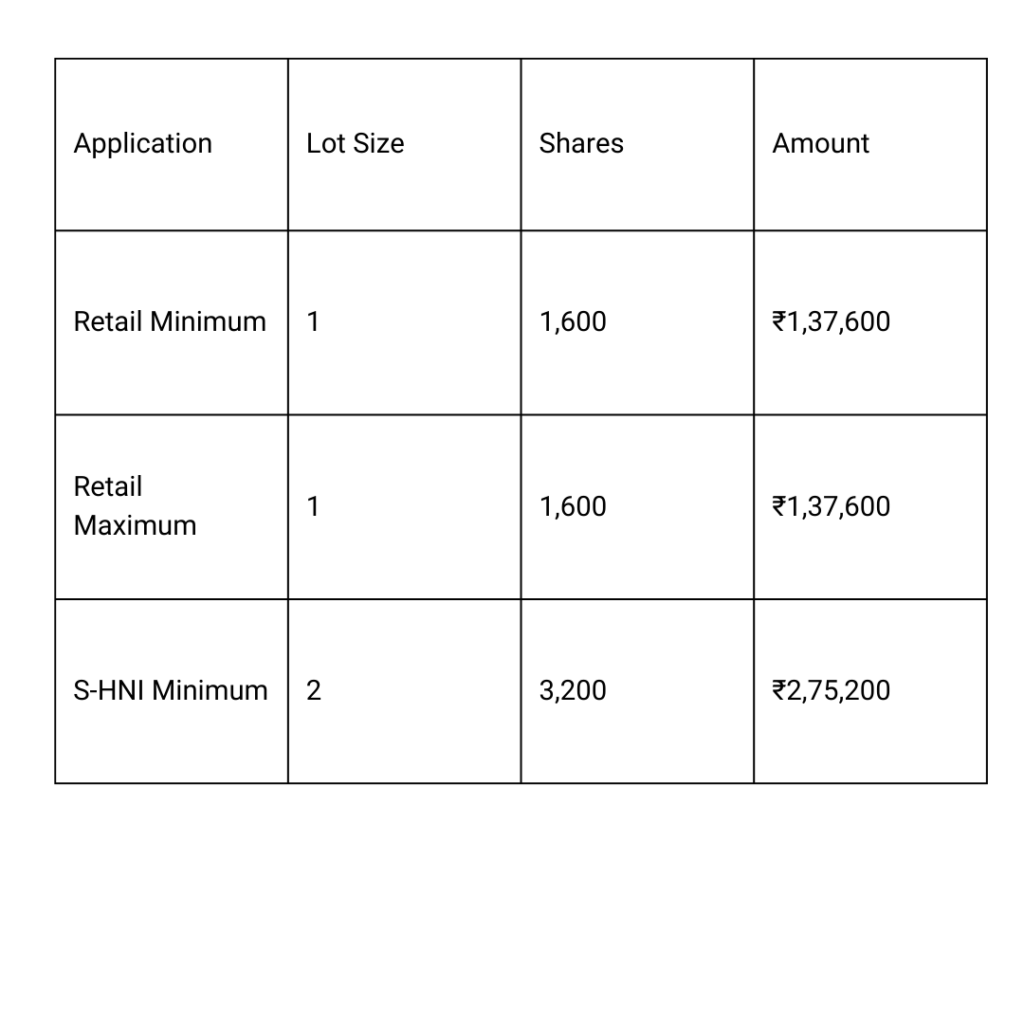

Rikhav Securities IPO Market Lot

Rikhav Securities IPO Company All Financial Report

Amount ₹ in Crores

Rikhav Securities Company All Financial Analysis

Return on Equity (ROE): 36.60%

- A high ROE indicates effective utilization of shareholder equity to generate profits.

Return on Capital Employed (ROCE): 29.48%

- ROCE shows the company’s efficiency in generating returns from its capital. A value close to or higher than ROE suggests balanced debt-equity management.

EBITDA Margin: 46.32%

- A strong EBITDA margin indicates efficient operations and the ability to cover operational costs comfortably.

PAT Margin: 40.94%

- This high margin reflects strong profitability after taxes, suggesting efficient cost and tax management.

Debt to Equity Ratio: 0.35

- A low ratio implies conservative use of debt, reducing financial risk.

Earnings Per Share (EPS): ₹14.23 (Basic)

- Indicates strong earnings available for equity shareholders, a positive sign for investors.

Price/Earnings (P/E) Ratio: N/A

- Likely unavailable due to lack of current market price or new listing status.

Return on Net Worth (RoNW): 30.89%

- Shows profitability relative to shareholder investments, aligning closely with ROE.

Net Asset Value (NAV): ₹46.08

- Indicates the book value of equity per share, a baseline measure of worth.

Key Takeaway:

The KPIs suggest a company with strong profitability, efficient capital utilization, and conservative debt management. This makes it attractive for investors, subject to understanding industry-specific benchmarks and market conditions.